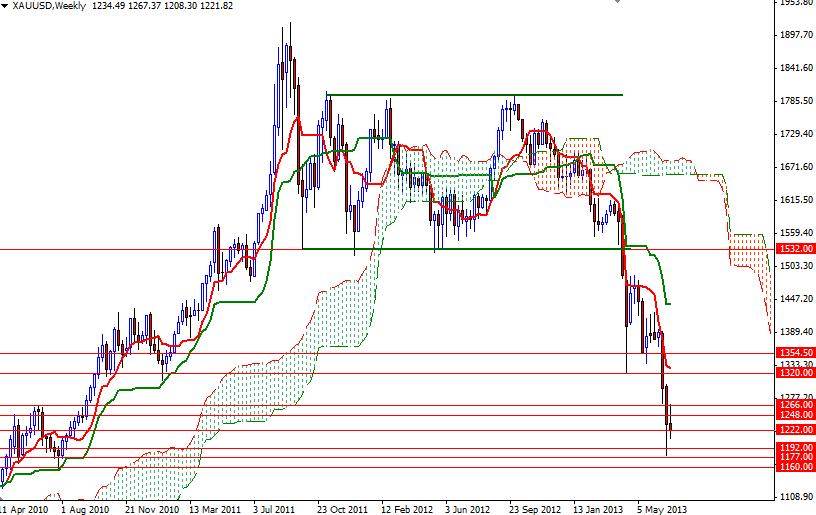

The major focus of the last trading day of the week was encouraging employment data out of the world's biggest economy. The XAU/USD pair traded as low as 1208.30 as the American dollar gained strength across the board after the Labor Department reported non-farm payrolls grew by 195000 in June, well above expectations of 165000. It appears that the strong recovery in the labor sector reinforced the expectations the Federal Reserve will begin to reduce its aggressive monetary stimulus sooner rather than later. Recent data out of the United States confirm that the economy is steadily recovering and the Greenback remains supported because of that. With that in mind, expect to see the market in a cautious stance. Until both fundamental and technical conditions change, it is highly probable that prices will continue to grind lower. On the other hand, as I mentioned earlier, since prices are approaching to the average cost of production, I believe that the 1000 - 1160 area will be attracting some serious buyers such as central banks which have been looking to increase the proportion of gold in their reserve assets. At this point I have no interest in buying gold because of the technical outlook as well. The XAU/USD pair is still trading below the Ichimoku cloud on the weekly and daily time frames. In addition, prices fell below the cloud on the 4-hour chart during the last session. Friday's settlement occurred at an important level (1222) and therefore I will be focusing on this level. If the current bearish trend holds true and prices make a sustained break below the 1222 level, I think we will test Friday's low of 1208.30. If this level is breached, the pair will likely test 1200. However, if prices climb and hold above the 1230.55 level, the bulls might gather some strength to tackle 1248. A daily close above 1248 would suggest that the next stop is 1266.

Gold Price Analysis - July 8, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Read more articles by Alp Kocak- Labels

- Gold