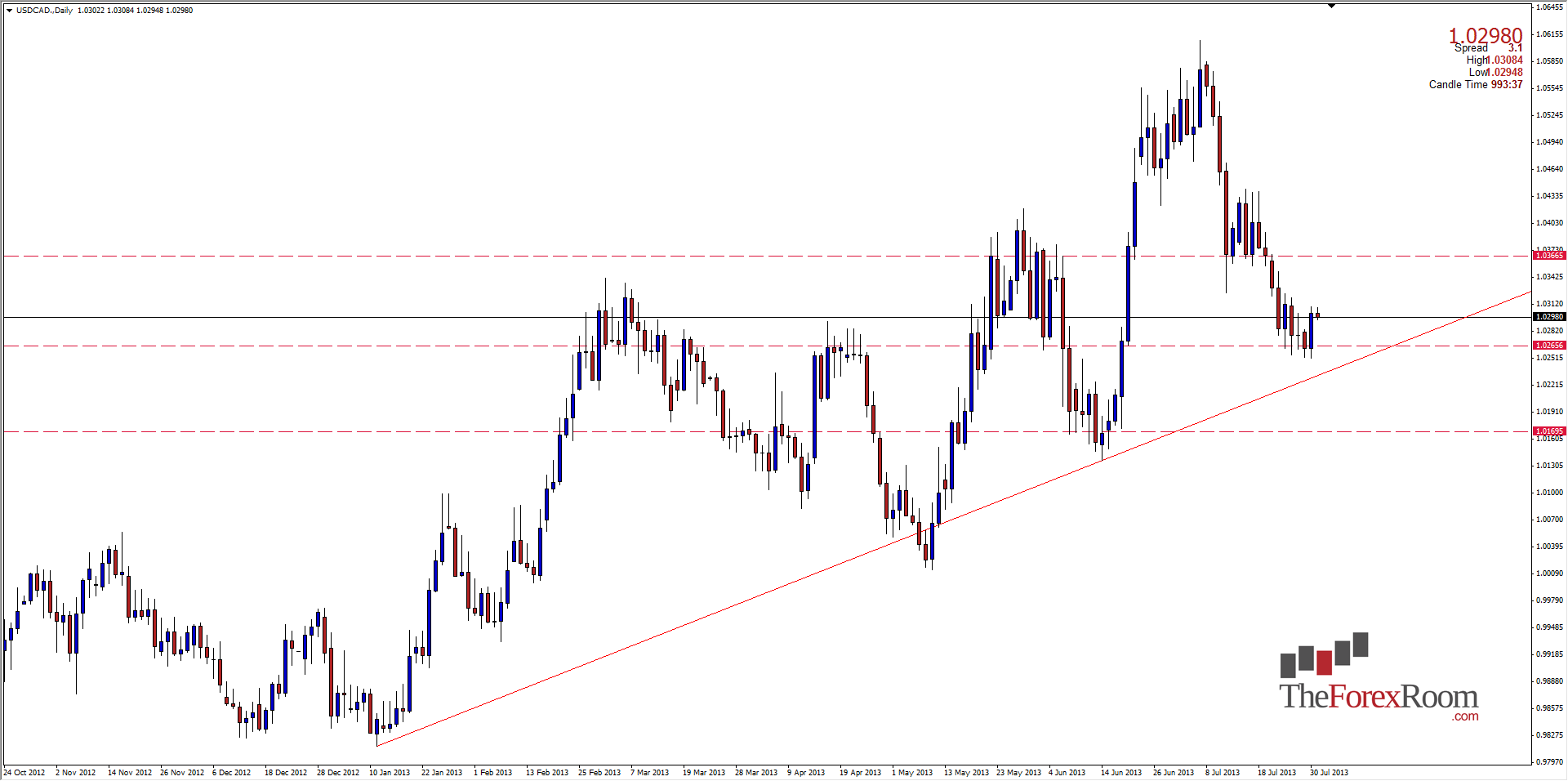

The Canadian Dollar, aka the Loonie as it is called, has been recently getting a little stronger against its southern cousin the American Greenback. It reached its weakest point against the dollar On July 7 at 1.0511 and began regaining some ground immediately, turning bearish the very next day. Since then, the pair has reached as low as 1.0252 and yesterday printed a bullish engulfing candle off of this very level which is acting as support. We saw previous highs at this level in February and again in March, then it became support when the pair broke above this level on May 22. The pair is still considered Bullish at this point, trading essentially in a rising channel on the daily chart since early January. That stated, if it can close below 1.0250 on a daily time frame, we could see the pair retest 1.0180 where the 200 EMA resides and lows from June can be seen consolidating, or even parity where we see lows from April and highs from late January. The more likely scenario is that it will honor the rising channel however, and retest last week’s lows in and around 1.0350-1.0370. 1.0400 and 1.0450 will be further resistance if we do in fact head back upwards.

Loonie (USD/CAD) Gives A Little Back

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- USD/CAD