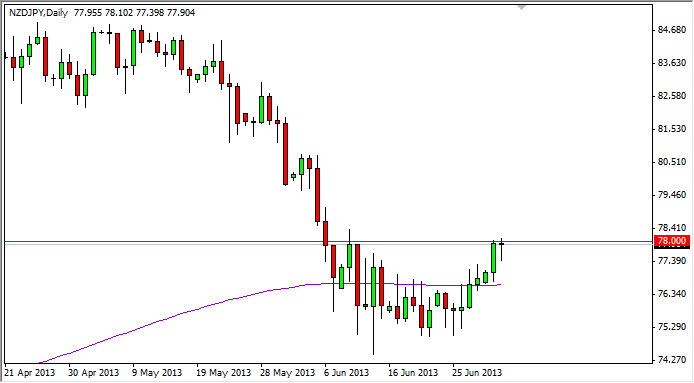

The NZD/JPY pair fell during most of the session on Tuesday, but as you can see bounced enough to form a hammer at the end of the day. This hammer is at the top of the recent surge higher, and seems to be centered on roughly 78. The 78 level has been resistance previously as you can see back in early June, but the market does look like it's trying to breakout to the upside at this point in time, as the Yen continues to get sold off against most currencies.

Although the US dollar reigned supreme during the session on Tuesday, the fact is that the Yen has been sold off against most currencies, and the New Zealand dollar of course won't be any different. In fact, this could be the beginning of the "carry trade" winding back up. After all, this pair tends to do very well in that environment, with the swap paying positively at most brokers.

78 is important, but 80 is above.

The 78 handle is of course important, but as you can see the 80 handle isn't far off either. It's because of this I believe that a break of the highs for the session on Tuesday leads us to that level, but we may struggle therefore a little bit. Ultimately, I think that the selling of the Japanese yen is coming back into vogue, and because of that this pair should do quite well. In fact, I would not be surprised to see this market print 85 sometime over the course of the next month or two.

On the other hand though, if we break the bottom of the hammer for the session on Tuesday, we would have to deal with support at the 200 day exponential moving average, shown in purple on the chart attached. The fact that we have broken back above it suggests that perhaps the longer-term money is coming back into play, which of course is normally is good news. That being said, I am very bullish of this pair on just the slightest move higher.