By: Daily Forex.com

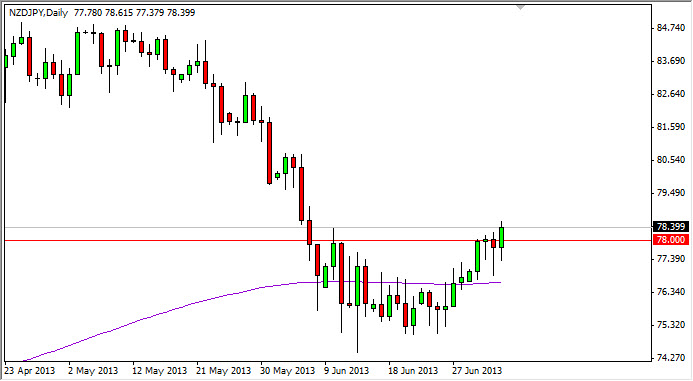

The NZD/JPY pair initially fell during the session on Thursday, but as you can see we broke above the top of the hammer that had formed on Wednesday. Now that we are clearly above the 78 handle, it appears that this market is ready to go higher, and it should be noted that the 200 day exponential moving average is below the recent cluster of trading, suggesting that more and more support is coming into the pair.

The shape of the candle for the Thursday session is in quite a hammer, but it does suggest the same thing. We tried to see the market fall, but of course it never did and the market bounced significantly enough to interest me again.

Bank of Japan continues quantitative easing.

With the Bank of Japan continuing its quantitative easing program, it's almost impossible to imagine a Yen that continues to gain in value overall. On top of that, the New Zealand dollar tends to move much quicker against the Yen in general, and as a result this is a bit of a fast market due to those conditions.

I believe that breaking above the highs of the session for Thursday is an excellent buying opportunity, and the fact that the nonfarm payroll number comes out during the session will more than likely make people wait until after that announcement to do so. For those of you that are bit more conservative and do not like the volatility that this pair frames, you could simply wait until the daily close in order to make that decision on Monday. I am not interested in shorting this pair at the moment, I simply want to buy and as I want to sell the Yen against just about everything I can get my hands on right now.

Being patient is probably going to be the way to go for those of you again who are a bit more conservative in your trading. However, those of you that are a bit more aggressive, simply note that the Yen will more than likely only appreciate so far, so knowing that the central bank is behind you is also comforting as well even if you start to buy this pair now.