By: DailyForex.com

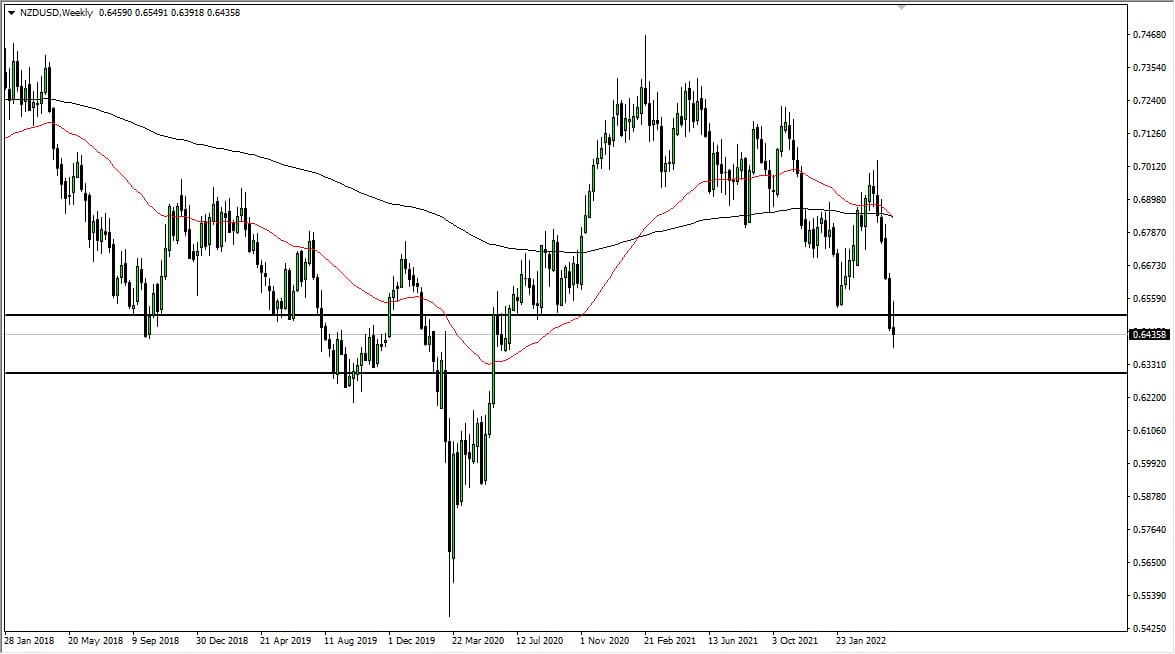

The NZD/USD pair had a back and forth session during Monday, eventually settling on printing a hammer. That being the case, it does look like the New Zealand dollar is going to get a bit of support in this general vicinity, and it's likely that we will see a short-term move higher. However, the downtrend is without a doubt very strong, and as a result I am not interested in buying this bounce. Rather, I am much more interested in selling a higher level.

I see the 0.80 level as a bit of an epicenter for resistance, and because of that I think that the area will more than likely offer a nice selling opportunity. After all, commodities have been a bit rough lately, and the New Zealand dollar is without a doubt very commodity sensitive. On top of that, growth in Asia isn't exactly strong, so the New Zealanders will certainly have issues with their economy going forward.

"Dead cat bounce."

This could very easily be a bit of a "dead cat bounce" for the Kiwi dollar. I have to admit though, the New Zealand dollar has outperformed its cousin, the Australian dollar. Nonetheless, the two tend to move in unison over time, so I do not see a situation where the Australian dollar gets extremely beat up while the New Zealand dollar escapes that scenario. Because of this, I think that selling this pair will be the way to go, but it looks like we may be omitted at higher levels. As far as buying is concerned, I have no interest in doing so but would admit that something has changed if we managed to get above the 0.82 handle.

Going forward, I fully expect see a little bit of a bounce, but sooner or later the overall economic weakness found around the world will wail upon the commodity currencies, and the New Zealand dollar of course will be no different than the other ones. With that being said, I am simply sitting on her signs that waiting for my opportunity above.