By: DailyForex.com

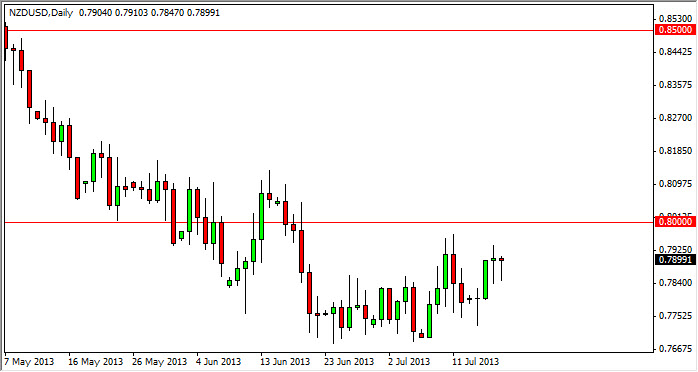

The NZD/USD pair fell initially during the session on Thursday, but as you can see bounced enough to form a hammer at roughly 0.79 or so. That being the case, I feel that this market is trying to breakout to the upside, but there is a significant amount of resistance up there that the buyers will have to chew through. Going forward, I'm really not interested in buying this pair until we get above the 0.82 handle, as that would be a clearance of serious resistance.

Going forward from there though, I would expect to see resistive action somewhere just above, and because of this I'm actually on the sideline right now looking for an opportunity to sell the New Zealand dollar yet again. Obviously, the trend has been very negative recently, and because of that I think that this market will more than likely find a lot of selling interest above, as the longer-term players step back into the marketplace.

Remember that it's summertime

The biggest trick with currency markets is that you cannot tell what the volume is. However, we know that a lot of the major players are out of the market during the summer months, simply because they are on vacation. I suspect that when they come back they will start punishing some of these commodity currencies. The New Zealand dollar has been given a little bit of a pass in comparison to the Australian dollar, which it typically moves hand-in-hand with.

Again, I think that we are going to be seen more significant liquidity in about for five weeks, so I would not be surprised at all to see this market grind sideways for quite some time, and then eventually show a nice resistive candle in order to start selling. On the other hand, if we get a break above the 0.82 handle on a daily close, I would not be able to argue with that and recognize the fact that serious resistance had been smashed through. If that happens, I am obviously going to start buying and I would aim for the 0.85 handle at that point in time.