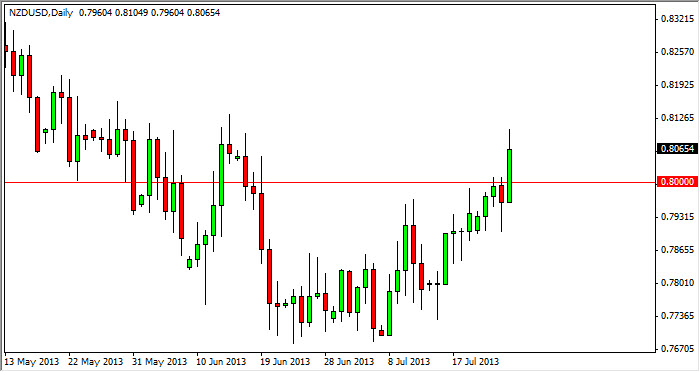

The NZD/USD pair skyrocketed during the session on Thursday, breaking the top of the Wednesday hammer that was placed at the 0.80 handle. That being the case, it's very likely that this market will continue to try to go higher in the short term. However, I think that there is a significant amount resistance all the way to the 0.82 level, and as a result I'm looking for resistive candles in order to start selling.

On the other hand, we do manage to close above the 0.82 handle on a daily chart, I think at that point time the New Zealand dollar has broken out to the upside, and the momentum is most certainly in favor of the Kiwi. Don't forget, the Federal Reserve is still going back and forth about whether or not it can taper off of quantitative easing in the month of September, and that most certainly will have a massive effect on this pair.

Expect volatility based upon headlines

The Federal Reserve and its thinking will be thought about quite a bit over the next several weeks, and little hints here and there in the news will be overblown as people try to "get ahead" of the Federal Reserve and its next move. That being the case, I fully anticipate seeing plenty of resistance above, just simply because it is in line with the downtrend that we've seen for so long.

With that being the case, I would have to admit that above the 0.82 handle, it looks like the New Zealand dollar is well undervalued, and that we should continue to go much higher at that point in time. Because of this, I think that this market will certainly make some type of decision fairly soon, and it does look like we will make a serious attempt to get to the 0.82 handle based upon the action that we sold during the Thursday session. If that's the case, we should have some type of decision fairly soon, and I will short that resistive candle, preferably some type of shooting star or something like that, or by a breakout above that level.