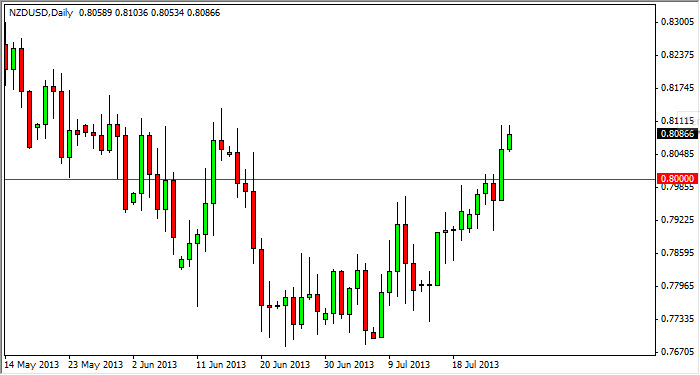

The NZD/USD pair rose during the session on Friday, but just barely sold. The 0.81 level offered enough resistance to keep the market down, and I believe that it is personally the beginning of a significant resistance zone all the way up to the 0.82 handle. In fact, I need to see the New Zealand dollar get above the 0.82 level to even begin to think about buying it. Until then, I am simply looking for some type of resistive candle in which to start selling. Unfortunately, I have not received that candle yet.

Going forward, I fully expect to see this pair breakdown, simply because the commodity markets themselves looked fairly weak. That being the case though, I have to admit the New Zealand dollar has been more resilient that its cousin across the Tasman, the Australian dollar. That being the case, this is probably the stronger of the two currencies, so quite frankly if this breaks down you might find more gains to be had selling the Australian dollar.

Asia is the answer

If you want to trade the New Zealand dollar, or the Australian dollar for that matter, following what's going on in Asia is the answer to which direction you should be trading. Both of these countries supply Asia with a lot of commodities, although it must be said that the Kiwis supply Asians with commodities that are more agricultural based on the whole. Nonetheless, as economies in Asia do better, they demand more commodities, and this of course helps the economies of both of these nations.

That being the case, I believe that this market will more than likely fall but I do have to admit that the 0.80 level being broken through so violently is indeed a very bullish sign. However, I do not believe until we get above the 0.82 level that we have truly broken through resistance. Because of that I would be very leery of going long at this point. I would either get my week candle to short, or start buying this pair above the aforementioned 0.82 handle.