Exactly one week ago in my last technical analysis of this pair, I noted that the price was sitting between overhead resistance beginning at 1.0655 and a recently established support zone stretching from 1.0420 to 1.0450.

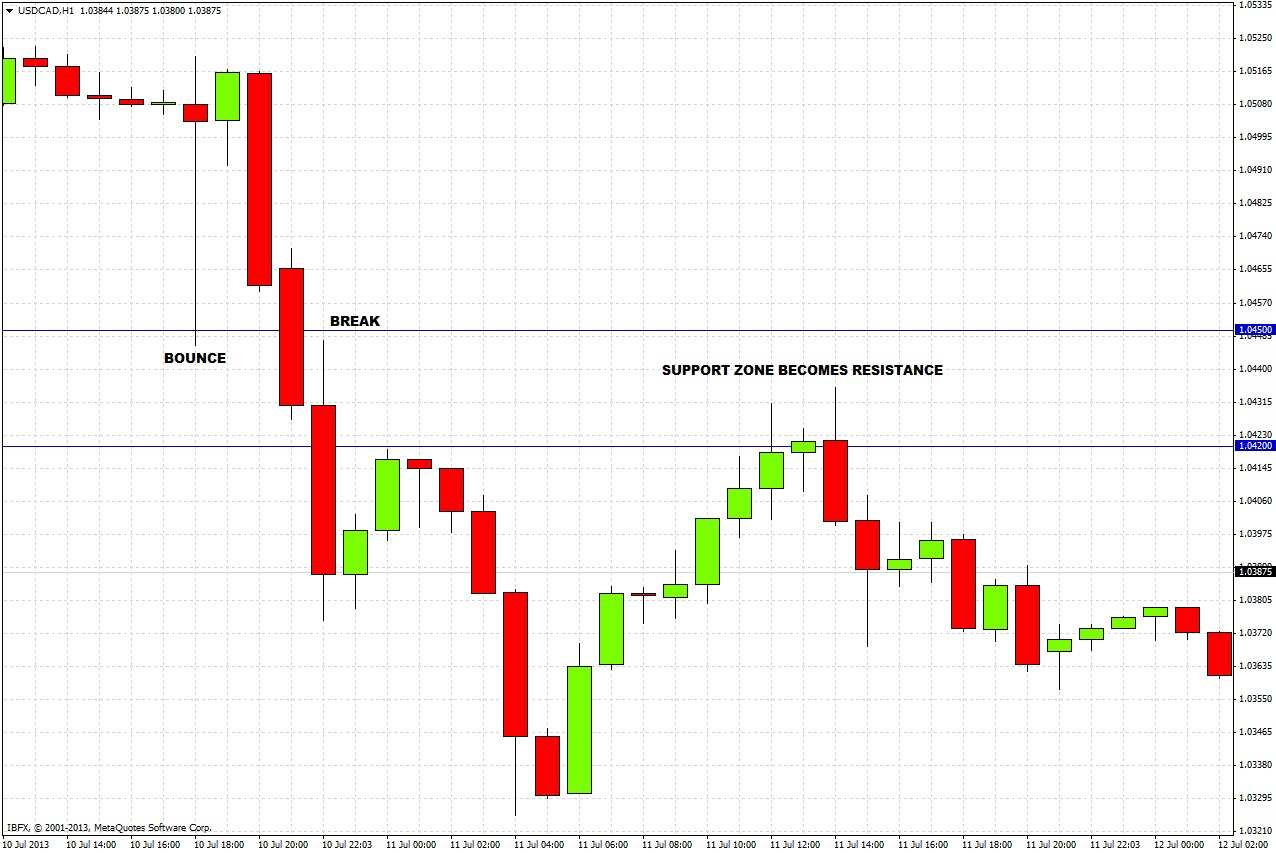

The only prediction I made that was tested was “if the price reaches 1.0450 first, we can expect a good bounce up provided 1.0420 is not breached meaningfully.”

At about 18:00 GMT on 10th July, the price did reach 1.0450, and it immediately shot right back up by about 65 pips. However only an hour later, the price fell again, slicing down clean through the 1.0420 level within only a couple of hours:

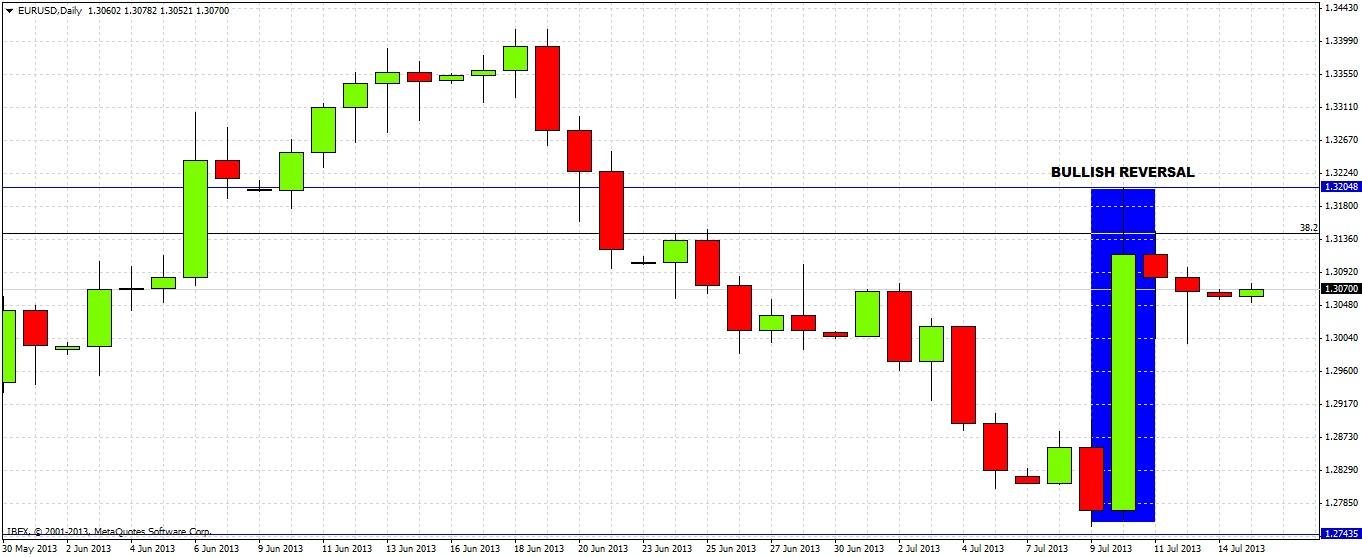

Turning back to the future, last week was important as the action printed a bearish reversal bar, taking out the two previous weeks and signalling a further move down:

The bearish reversal signifies that we should reach at least last week's low of 1.0325, and if this is breached decisively, continue downwards to the 1.0150 area.

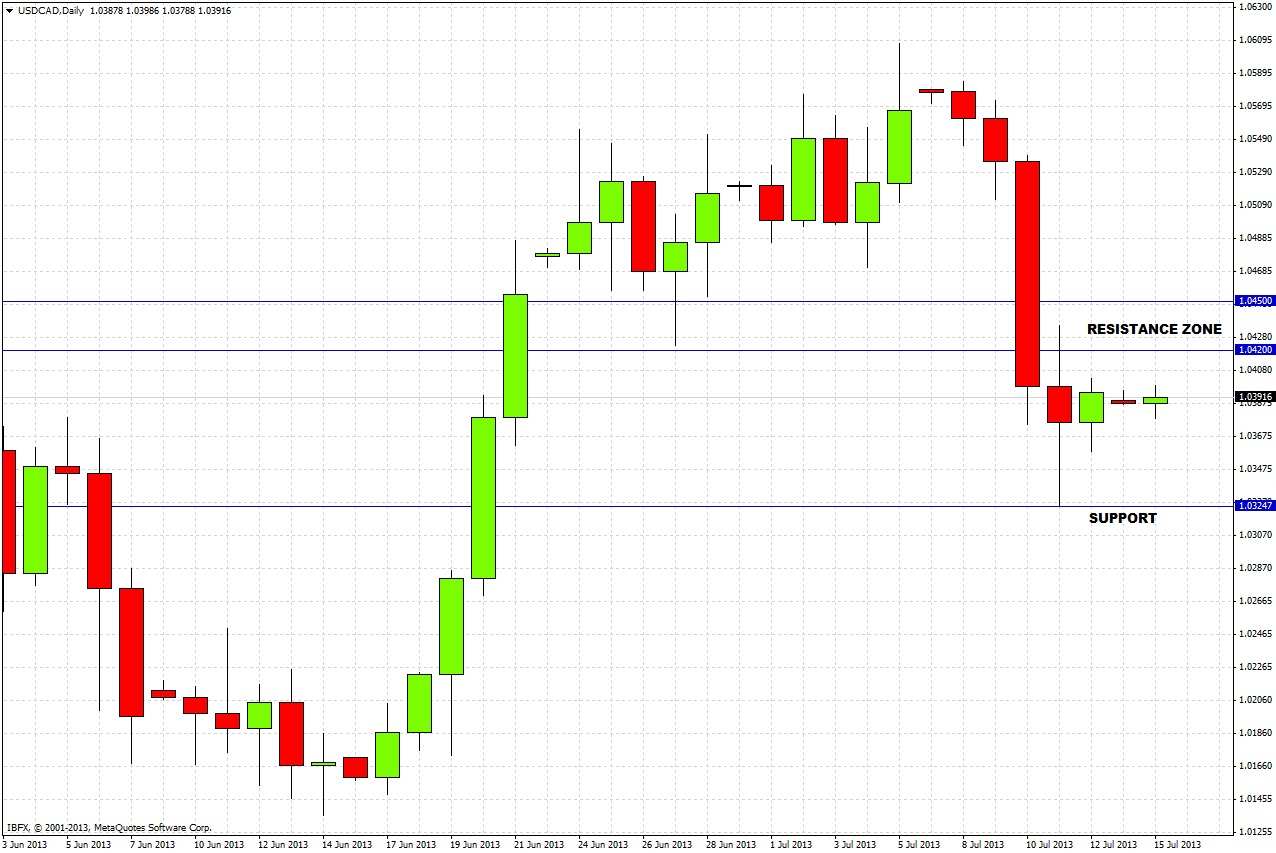

The daily chart adds little to the picture, showing only that the price has been consolidating for the last two trading days:

During the week ahead, we can work on the following basis:

1. The general outlook is bearish, with a retrace back towards the bullish trendline visible on the weekly chart, now sitting at about 1.0175.

2. There is a zone of overhead resistance from about 1.0420 to 1.0450.

3. There seems to be support above last week's low of 1.0325.

4. A rise up to 1.0420 during the next few days will present a good opportunity to look for short trades. A logical target is 1.0325 but be cautious and consider taking at least some profit once the price hits 1.0375.