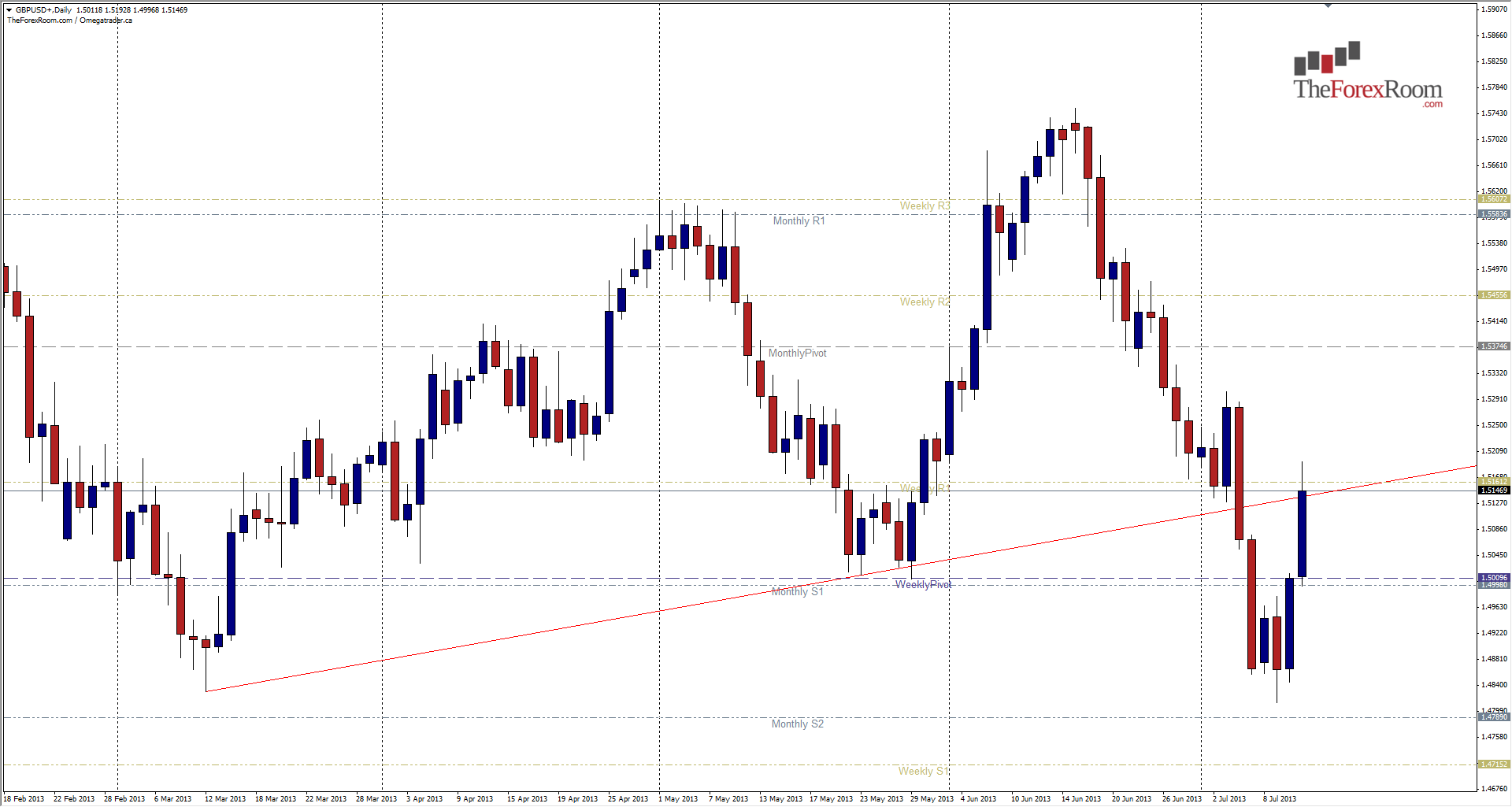

The Sterling appears to have bottomed out at 1.4813 for the time being, just 17 pips lower than the previous 2013 low set on March 12. The British currency began staging its recovery after hitting the low on Monday at around noon in New York and inching its way higher for the most part, until Mr. Bernanke’s comments mid afternoon yesterday when the stage was set for a massive ‘risk on’ run higher to the recent high at 1.5155 set early in Asian trading. This has brought the pair upwards about 342 pips and back above the crucial 1.5000 level. We can see from the chart that the trend line which was broken last week is now being re-tested, not uncommon when a break out occurs, as is the Weekly R1 at 1.5160. Further resistance is visible at 1.5225 with the EMA50 at 1.5294 followed by the Monthly Pivot at 1.5375. Taking into consideration Carney’s intentions for the currency, we can expect to see measures implemented soon to weaken the pound in order t boost manufacturing and exports, but for now it is possible that we will have a continued running of the bulls. Failure to close above 1.5250 will see support become important again with the 1.5000 level of the most importance followed by 1.4800, a break of which will certainly take the pair much lower rather quickly.

Sterling Stages Recovery

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Read more articles by Colin Jessup- Labels

- GBP/USD