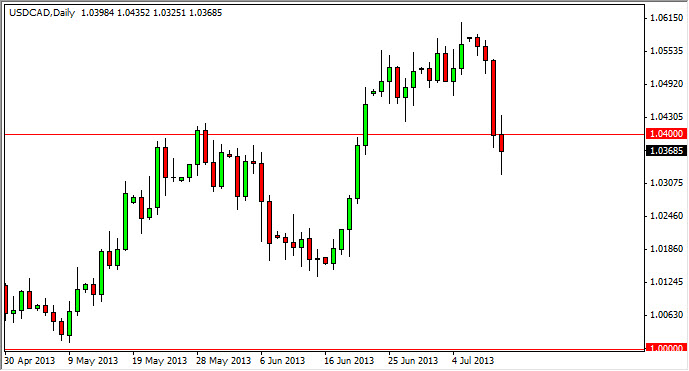

The USD/CAD pair fell during the session on Thursday, breaking below the 1.04 level for the first time in a few weeks. This has me a bit concerned for the pair, simply because that level should have been very supportive. However, we did see many above the 1.03 level, which was my "floor" in this marketplace that had to be held by the bullish traders out there in order to keep thinking long on this pair.

Oil markets sold off and the Canadian dollar gained. Interesting actually, considering that the rise in this pair has been exactly opposite as well. Oil markets rise and the Canadian dollar falls, which is normally completely out of sync, and we certainly sell that today during the session on Thursday. The fact that the Canadian dollar is gaining while oil is falling is very counterintuitive, and as a result it shows just how unhealthy the oil markets are right now, and the fact that they are starting to influence things in very bizarre ways.

1.03 is the most important level on this chart as far as I can tell.

I think that as long as we stay above the 1.03 handle in this pair, it should be fairly positively bias, but then again it seems that a lot of the markets are simply running on headlines at this point, perhaps exacerbated by the fact that it is the summertime its liquidity is probably a bit thin.

All things being equal, I think that if we can break the top of this candle though, that is a pretty decent sign for the pair and it should continue higher. I think that a break of that area is reason enough to start buying, and I will more than likely start doing so at that point in time. On the downside, if we managed to break the bottom of the candle for Thursday and the 1.03 handle, I think at that point in time this pair is going to at least parity, and possibly lower. These are interesting times in this pair, and we have a bit of a "binary trade" setting up, simply buying or selling depending on which side of the Thursday candle we break to.