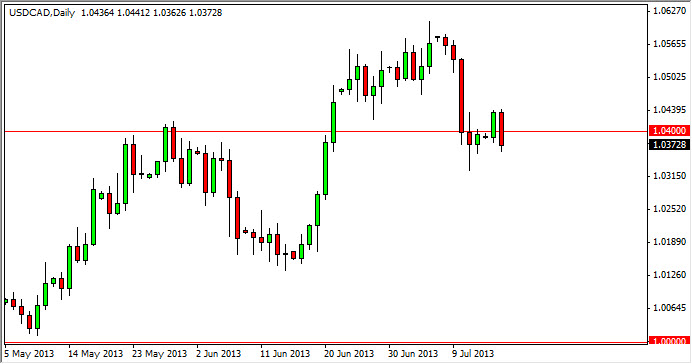

The USD/CAD pair fell during the session on Tuesday, slicing through the 1.04 handle again. However, this looks more like consolidation than bearishness, and as a result I'm not ready to place a trade in either direction. After all, Thursday of last week saw a fairly significant candle print, which looks like it is defining the consolidation area that we are going to be in in the short term.

That being said, I also find it interesting that oil is gaining, and overall we haven't necessarily seen the old style correlation between the Canadian dollar in the oil markets hold true every day. Going forward, I expect to see this market bounce around in this general vicinity, and it is not until we break either the top of the Thursday candle that I will start buying, or the bottom of the Thursday candle and I will start selling.

Canadian economic numbers aren't exactly rosy.

Canadian economic numbers recently have not been that strong. Because of this, I think that the Canadian dollar is being punished a little bit more than usual. Even though the US numbers have been a little bit better, the Canadians have not been able to ride the coattails of those economic numbers. Normally, the better that the United States does, the better that the Canadian dollar does. That obviously has changed quite a bit here recently, and as a result the US dollar has been the only game in town up until about two weeks ago.

I believe that right now we are trying to figure out the general direction, so therefore waiting until this consolidation area gets broken out is probably by far the smartest move. I know I have a biased to the upside, but that could be completely wrong, and the last thing I need to do is risk money on a "hunch", rather than the technical set up like I choose to trade 99% of the time. That being said, I am waiting for breakout of this general vicinity in order to place a trade in one direction or the other.