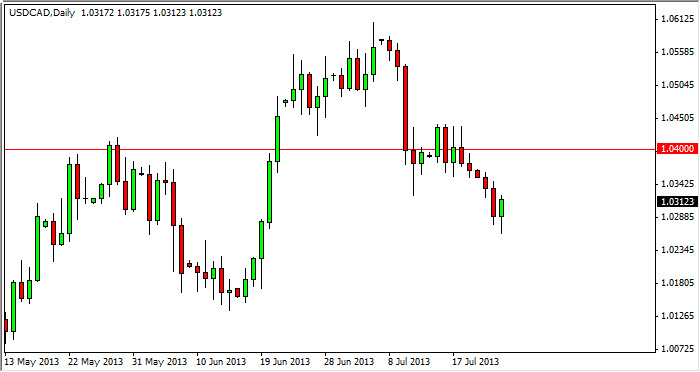

The USD/CAD pair rose slightly during the session on Wednesday, bouncing off of the area just below the 1.03 handle. The resulting candle is a hammer, and it does suggest that perhaps the market could bounce in the short term. However, I feel that after the relatively weak performance that we've seen over the last two weeks that it's probably safer to wait until we break out above the "brick wall" that we had seen a couple of weeks back. This of course is centered on the 1.0450 level, and as a result I want to see a daily close above that level in order to start buying.

I think that if this candle breaks to the upside, although there is a potential long position there, I think there is just simply far too much in the way in order to feel safe. If you are short-term trader, it might be possible, but anybody who wants to get up and get away from their desk will more than likely have trouble hanging onto this trade until we clear the above-mentioned brick wall.

Watch the oil markets

The oil markets of course always have an influence on the Canadian dollar, and as a result it will be interesting to see what happens. During the Wednesday session we got better than expected economic news out United States, and as a result there is fear that the Federal Reserve will "taper off" of quantitative easing in September. If they do, that will continue to push the value of the US dollar higher, and oil lower. In turn, this should also push this pair higher as the Canadian dollar should lose strength.

However, I do recognize the fact that we broke the bottom of this hammer, there is very little to stop us from hitting the 1.01 handle. Below there, I would expect parity be targeted next, and at that point who knows what would happen? Going forward, I think it's more likely that we see a selloff, but I don't know that it's going to be that drastic.