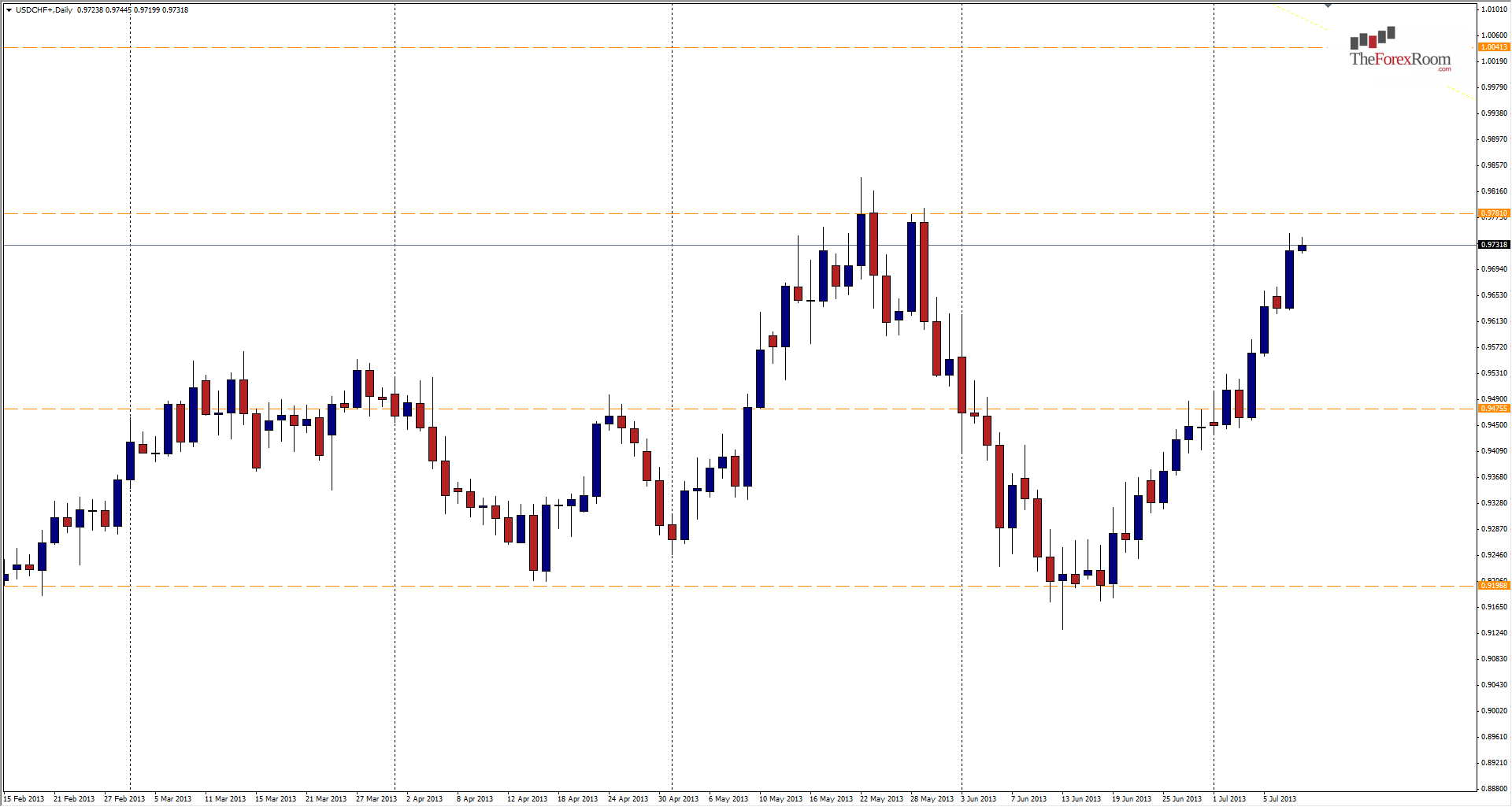

The Swiss Franc continues to weaken against the US Greenback with another bullish day yesterday that topped out at 0.9751, just shy of a weekly resistance level of 0.9780 and the recent highs from May in the same ball park. Is the Swissy going to hit parity for the first time since 2010 soon? It sure looks that way and with the main event in the USA today of FOMC and Bernanke’s pep talk we could see another surge in the US Dollar across all pairs. If that happens, the resistance at 0.9780 should break with relative ease and the next real hurdle will be the lows from August 2009 at the 1.000 area. If the Fed decides its not quite time to pull the pin on bond buying and QE then the dollar will most likely weaken and see support at 0.9650, 0.9550 (March Highs) and 0.9475 (50% FIBO Retracement Level and consolidation area from March/April) become the focus.

Happy Trading!