Exactly one week ago I predicted that:

• Price is currently likely to range between 98.50 and 100.81 in the short term and between 95.73 and 101.43 in the longer term.

• Price is nearer the top of its range, so shorts look more probable than longs in the very short term.

The prediction turned out to be correct, although my short term was very short! The pair did break 100.81 the next day, and tested 101.43 as soon as this week opened, but was unable to stay above that level for longer than an hour. Since the failed test of 101.43 the price fell, and this morning tested the predicted support at 98.50 twice. Price was unable to stay below that level for any length of time, and has now turned around to rise this morning. The hourly chart of the last week shows the story:

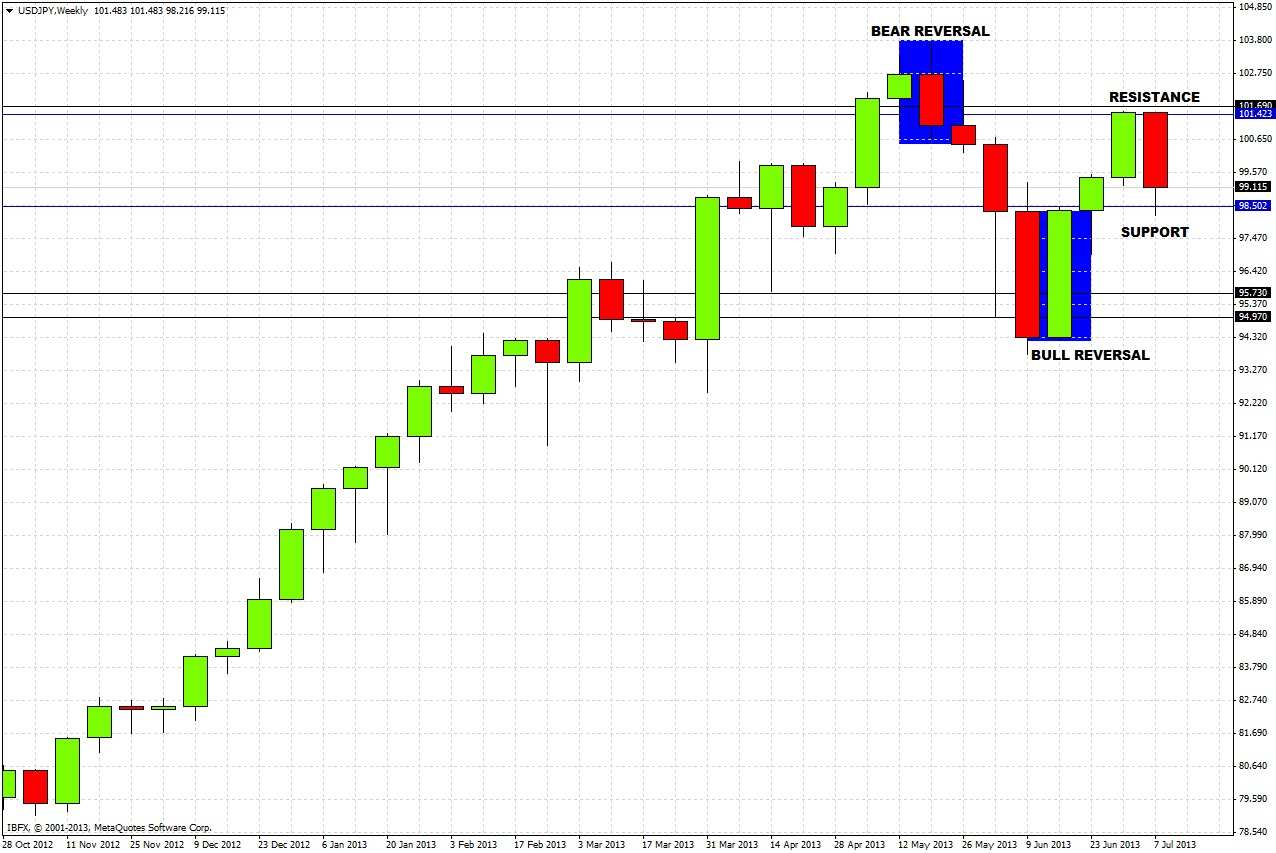

The monthly chart tells us nothing new since last week. The weekly chart below shows that this week is on course to become a bearish reversal off the resistance at 101.43, if the price closes on Friday below 99.43. If this were to happen, we would probably see another test of 98.50 next week and possibly a fall below that. If the price closes the week above 99.43, we will probably see a more gentle test of the support, if at all, with price being more prone to continue ranging.

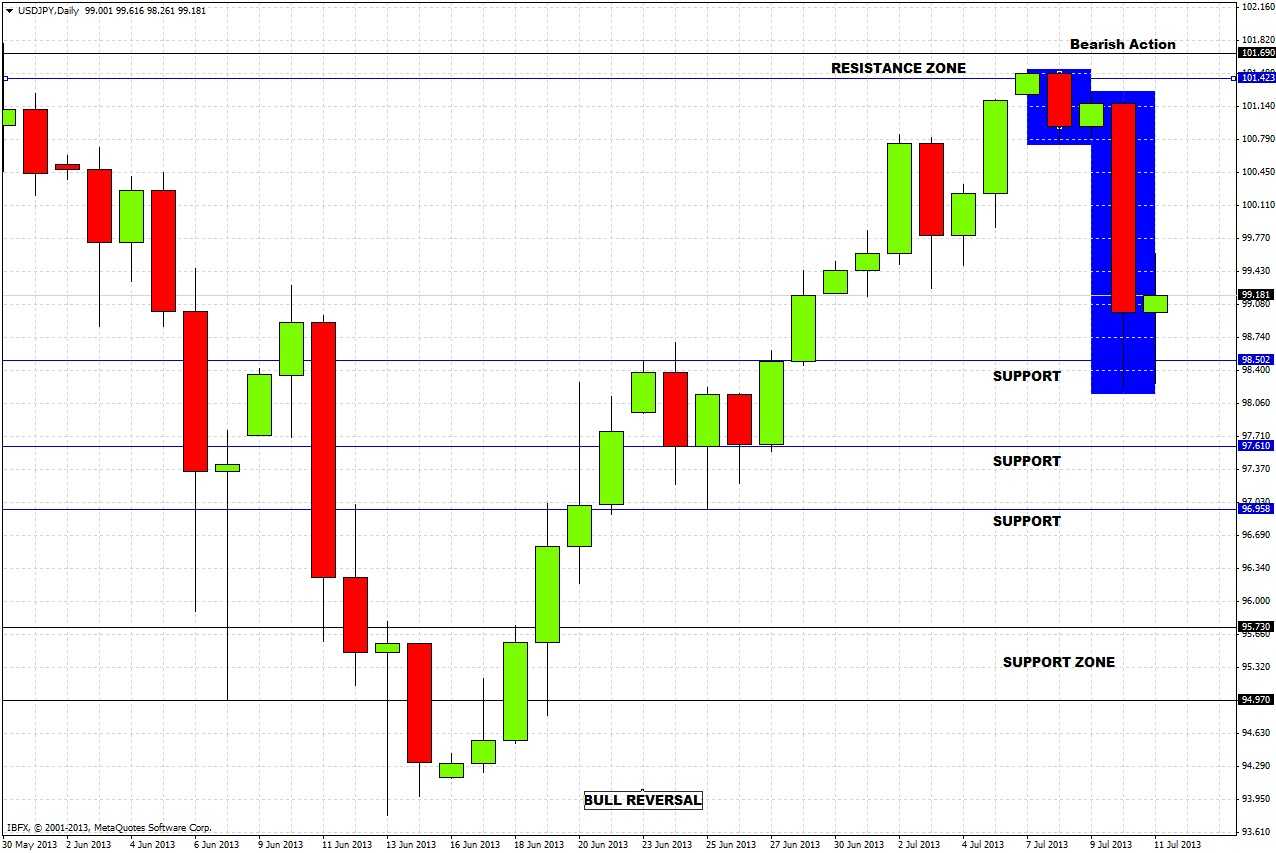

The picture looks more bearish on the daily chart, with a bearish reversal day happening yesterday:

Unless the price shoots right back up again to 101.43, we can expect another test of 98.50 fairly soon. If the price breaks down through 98.50, it should fall to around 97.61 where quite strong support was established over several days last month. A break of that level next week would be very bearish, signaling a fall to 97.00.

In conclusion:

• The longer-term trend is still bullish as long as the support zone of 95.73 to 94.97 holds, but the shorter-term picture looks bearish.

• 98.50 is likely to be tested again soon and if broken decisively we would see 97.61, which should prove to be stiffer support.

• If this week closes below 99.43, a successful break down through 98.50 is more likely.

• If this week closes above 99.43, especially if there is another unsuccessful test of 98.50 later today or tomorrow, we might see a rise next week to test 101.43 instead.

For the rest of this week, the best trade opportunities will probably be shorts from any pull backs close to 100.00, with initial targets of 98.50. Alternatively if 98.50 is broken down, a logical short target would be 97.61.