By: DailyForex.com

Last week I predicted that 98.50 and 101.49 were the key levels to watch out for. Since then, neither of these have been tested, with the price ranging well within these limits. I also said that the short term trend looked weakly bullish. As we can see from the hourly chart showing the past week, we have been making mostly both lower highs and higher lows, i.e. we have been consolidating:

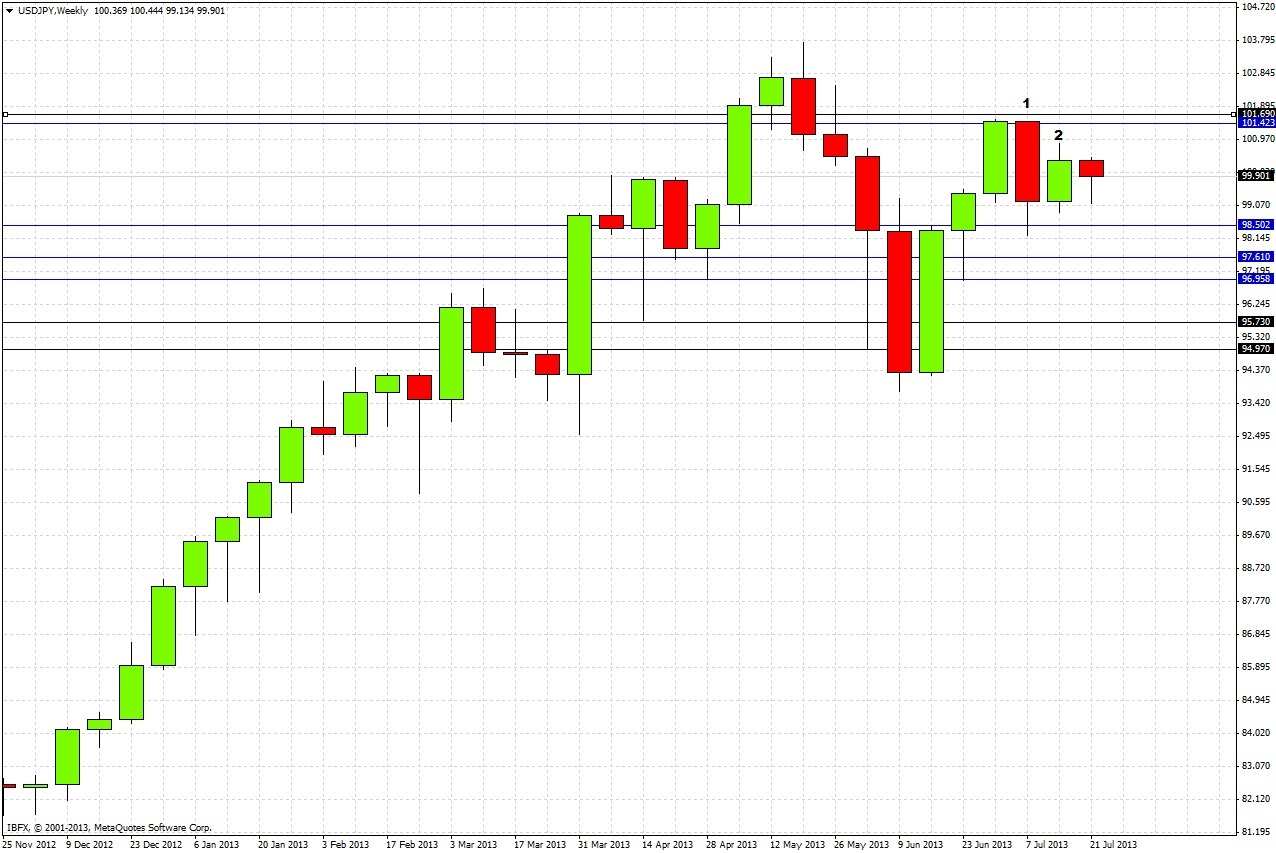

The weekly chart printed a bearish reversal the week before last (1), followed by a bullish inside bar (2), neither of which have yet been broken to either side:

This gives us a very uncertain picture, strongly suggesting continued consolidation.

Dropping down to the daily chart, there has been little change since last week. The upside break of the bearish reversal bar suggests weak bullishness (1), as does the slightly upward trend of the last two weeks (2):

We can learn something else from the daily chart: the consolidation pattern has formed a narrowing triangle, which the price is going to have to break out of by some time next week.

To conclude, the picture is uncertain, confused, and consolidating. This pair has still been the biggest mover in the forex market lately on most days, which shows that the market has become very dull, as even the biggest mover is not doing very much. We are still in pretty much the same position that we were last week:

• The longer-term trend is still bullish as long as the support zone of 95.73 to 94.97 holds, and the shorter-term picture looks weakly bullish.

• 98.50 may be tested again soon and if broken decisively we would see 97.61, which should prove to be stiffer support.

• If this week closes above 101.49, we are likely to see a bullish week next week with a target of 103.72.

For a sign before reaching any of these levels, we should look for a daily close beyond the triangle's trend lines in either direction. If this will be a bullish breakout, it would be a slightly more reliable indication of a renewal of bullish momentum. But we should not be too confident of anything that happens between 98.50 and 101.49.