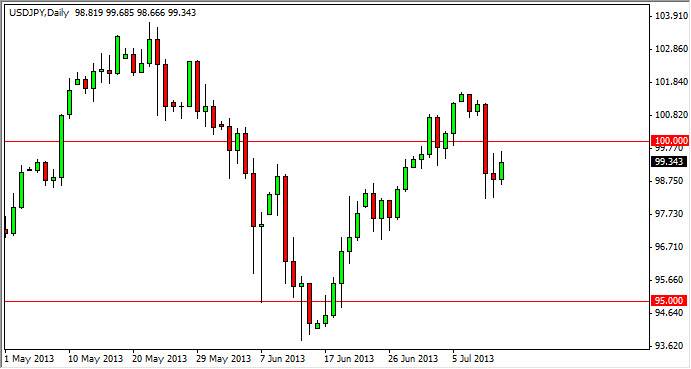

The USD/JPY pair seems to have firmed up a little bit during the Friday session, showing that the 99 handle continues to be important to the buyers. The market has been sold off rather drastically over the last couple of days, but quite frankly I don't think that much is changed. True, the Federal Reserve released minutes from the last meeting that showed many of the members were concerned about employment in the United States and whether or not they should taper off of quantitative easing, but in the end it looks like the Federal Reserve will find itself having to think about it regardless. After all, there are other inflationary numbers out there that are starting to pick up a bit.

That being said, I think this market should continue to go higher, and would because the Bank of Japan will make sure that it does sooner or later. The 100 level above is a good point in which to start buying if we can close above it, because it shows that the market is willing to grind higher. If we get that move, I fully expect to see the market attempt to reach the 104 level, and possibly the 105 level over the next several weeks or even months.

It will be interesting to watch what the larger firms do when summer is over

When traders come back from the summer break, you can often see a significant move in one direction or another. I can't imagine that they would be selling this pair off, so I suspect that in the next couple weeks we will see a significant move higher. I can't say when it is, but quite frankly I can only use the 100 level as a gauge as to when I should start buying. Alternately, there is the possibility that we pull back even further, and form some type of supportive candle below. That's an even better buy signal as far as I'm concerned, as it offers a "cheaper Dollar." I have absolutely no scenario where I'm selling this pair, and believe that the 95 level is the "floor" in the market right now.