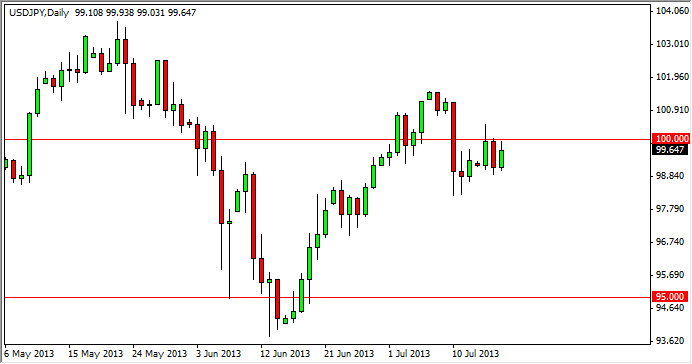

The USD/JPY pair rose during the session on Wednesday, as you can see. The 100 handle offered too much resistance though as usual, and as a result the market looks like it's ready to grind just below that all-important area.

I personally believe that this market is going to be very tight for the time being, and it's going to take something very special to move prices higher. I believe that we will go higher in the end, but we need to clear the top of the range that we have been in recently, which would basically put us at about 100.50 on a daily close. If that did in fact happen, I believe that this market would more than likely head towards the 102 level in fairly short order.

Beyond there, there is the 103 level, and then the 105 level. I believe the 105 will be reached sometime between now and the next few months, but expect a bumpy ride between here and there. The Forex markets have been very difficult to deal with from time to time over the last two years, and this pair has stopped being a "one-way trade" like we had seen earlier in the year.

Bank of Japan continues to work against the Yen

The Bank of Japan continues to work against the value the Yen, and as a result I am not a seller of this pair under any circumstances. With that in mind, I believe that the 95 level is the "floor" in this market at the moment, and certainly will not be penetrated without the Bank of Japan getting somewhat upset and concerned. I believe below that area the Bank of Japan would start to intervene in the markets, and most certainly would say something.

The way these markets work lately, it really wouldn't take much more than jawboning out of the Bank of Japan to get a lot of people freaked out, and prices rising rapidly again. Again though, I still believe in the long-term validity of the uptrend, and will be looking for opportunities to buy this pair.