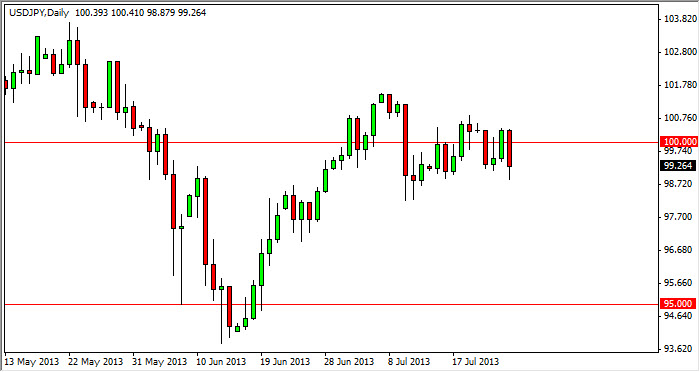

The USD/JPY pair fell during the session on Thursday, falling below the 100 level yet again. However, I feel that the bounce that we saw off of the 99 handle suggests that we are going to continue to grind away in this general vicinity. After all, a little bit of a consolidation area often will give buyers the strength to continue to go higher eventually. Also, this is the battleground of interest rate differential that we see between the United States and Japan, which of course is one of the more interesting fights that we see in the Forex markets right now.

The Federal Reserve should make a relatively monumental decision in September, and as a result the markets are trying to figure out whether or not they are going to taper off of quantitative easing or not. If they do, that should bring the value of the US dollar higher, and that will be especially true in this market as the Bank of Japan is just now beginning its quantitative easing program. This program is monumental and massive and its size, and as a result we think that the Yen will continue to be devalued for the long-term.

Headlines will move this pair drastically

Any word out of the Federal Reserve could possibly move this pair as people begin to worry about whether or not the tapering is going to happen. Any time that it appears that there is serious doubt, this pair will fall. On the other hand, any time the tapering chances are strong, this pair will continue higher.

This pair is probably the perfect battleground, simply because the Bank of Japan is without a doubt going to ease their monetary policy, while the Federal Reserve is still bid up in the air. But if they start to taper off of it, that is tantamount to tightening monetary policy, and that makes this pair the perfect storm as you have a currency that is going higher as far as interest rates are concerned, while another one that is mired towards the zero level.