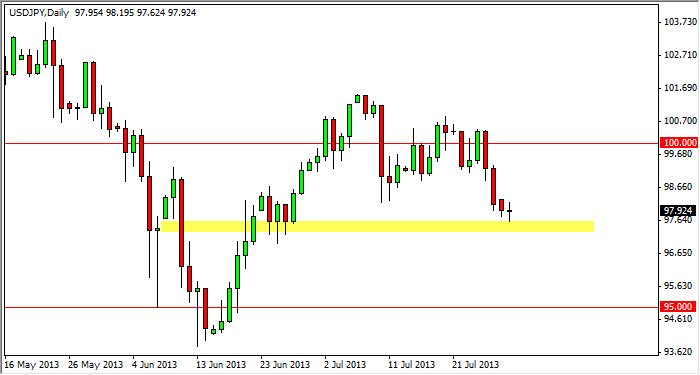

The USD/JPY pair did very little during the session on Monday, essentially confirming that the area is going to attract a certain amount of buyers. The 98 handle has been important time and time again, so this does not surprise me at all. However, there's really nothing on this chart that makes me feel like I should be buying the pair quite yet.

A move higher would be a reason enough to start buying, but in retrospect this market has been one that you can take your time with for several months now, as eventually the marketplace goes higher. The Bank of Japan will continue to work against the value of the Yen, no matter what happens. That being the case, I am still only buying this pair, but what I am looking for are signs that we are about to get a pop higher. Right now, I don't see one, but I do respect the fact that we are essentially in the neighborhood that I need to be in in order to get that type of action.

Headlines will move this pair drastically

The Federal Reserve and its plans for tapering off of quantitative easing are probably the most important aspects of this pair right now. That being the case, if the Fed looks like they are going to taper off of quantitative easing, this pair will be one of the most explosive ones in the Forex realm. I would not be surprised if this pair suddenly became the only one to trade again. I would be looking at least 1000 pips higher, and profitably more over time.

However, right now we are not at that point. But I keep that in the back my head because I think eventually this will happen. The Bank of Japan is at the beginning of its easing cycle, while the Federal Reserve is at least getting closer to the end. Beyond that, I am simply looking for some type of signal to start buying. I do not have one right now, but any type of supportive candle would be enough to get me involved.