By: DailyForex.com

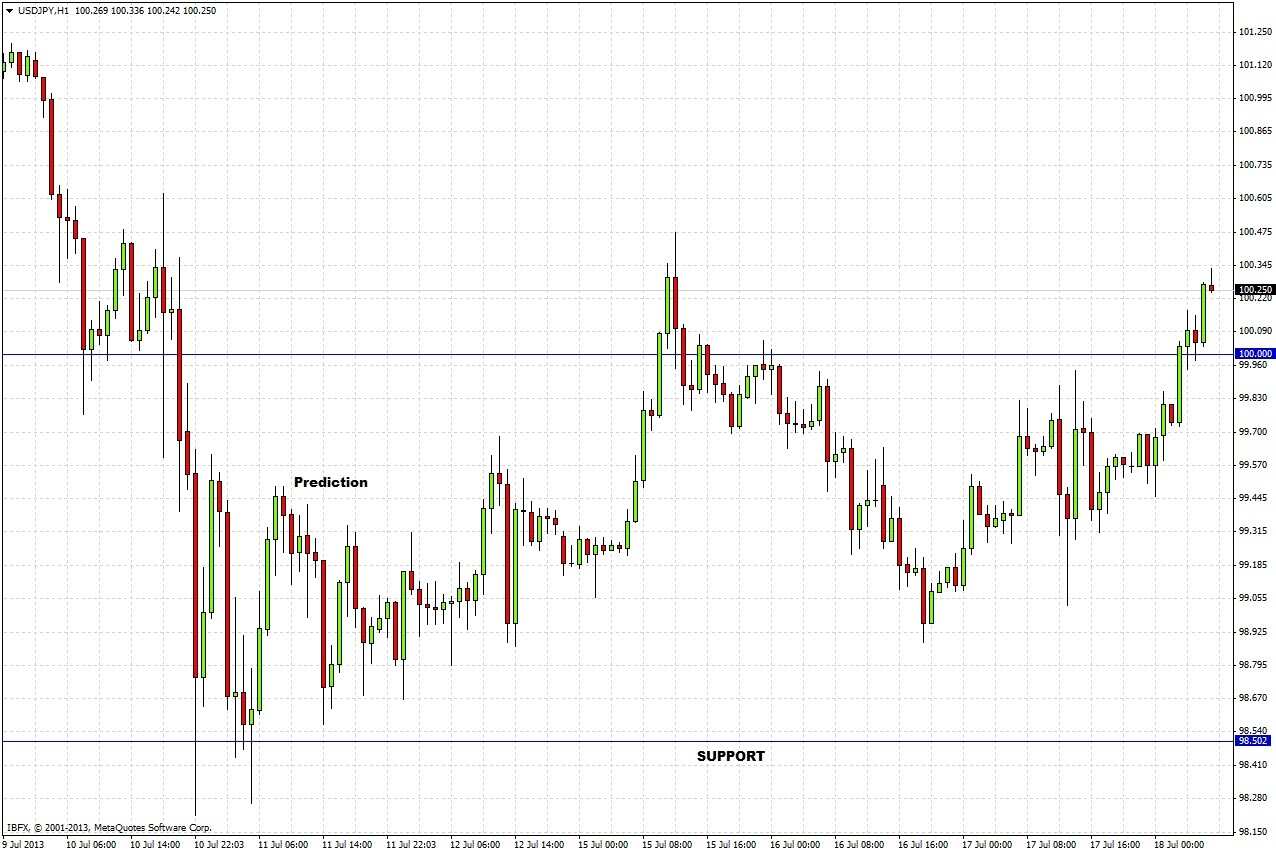

Here are the predictions I made in my last USD/JPY analysis one week ago that apply to how the market moved since then:

• 98.50 is likely to be tested again soon and if broken decisively we would see 97.61, which should prove to be stiffer support.

• If this week closes below 99.43, a successful break down through 98.50 is more likely.

• If this week closes above 99.43, especially if there is another unsuccessful test of 98.50 later today or tomorrow, we might see a rise next week to test 101.43 instead.

For the rest of this week, the best trade opportunities will probably be shorts from any pull backs close to 100.00, with initial targets of 98.50.

What actually happened? Although last week closed a little below 98.43 (at 98.19), 98.50 has not been retested since my last analysis. I was wrong there, but my forecast that the best trading opportunities for the remainder of the week would be short trades from areas close to 100.00 was exactly right:

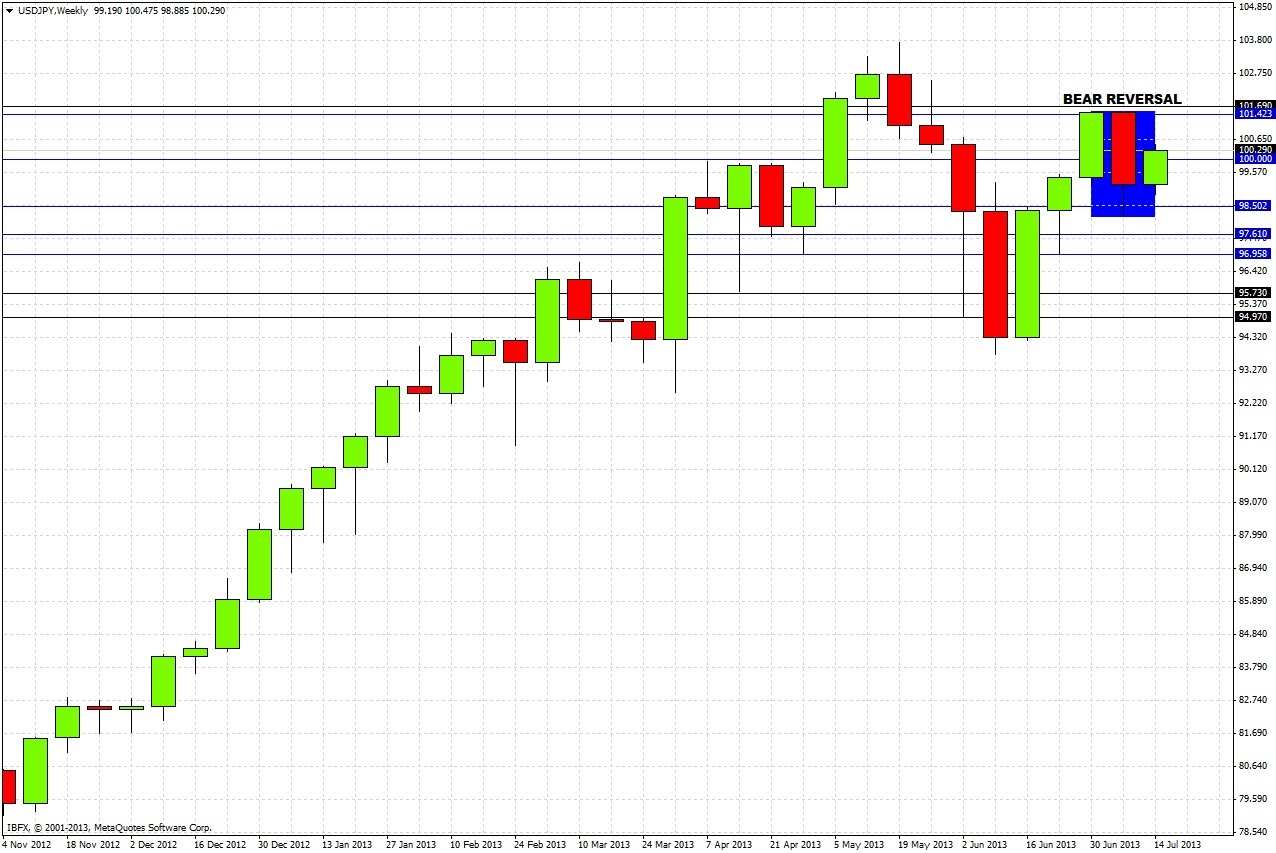

The monthly chart tells us nothing new since last week. The weekly chart below shows that last week was a bearish reversal off the resistance at 101.43:

It is interesting to note that the low of last week has not been broken, and that the action last week has been mostly bullish, suggesting a loss of bearish momentum and a move to consolidation, should this week close above its open.

Going down to the daily chart for more details makes the picture a little clearer:

Last Friday produced a bullish reversal bar which was broken to the upside the very next day. However just after that, last Tuesday produced a bearish reversal, but this reversal was itself invalidated by being broken to the upside this morning, following yesterday's bullish inside bar.

To conclude:

• The longer-term trend is still bullish as long as the support zone of 95.73 to 94.97 holds, and the shorter-term picture looks weakly bullish.

• 98.50 may be tested again soon and if broken decisively we would see 97.61, which should prove to be stiffer support.

• If this week closes above 101.49, we are likely to see a bullish week next week with a target of 103.72.

Overall, the picture is too uncertain to identify any good trade opportunities beyond longs from bounces up from 98.50 and/or shorts from bounces down from 101.43.