EUR/USD

The EUR/USD pair had a negative week to say the least. It closed just above the 1.28 handle that I have suggested as a “floor” in the market, and looks like it could try and break down below that level soon. However, there is a serious chance of a bounce from here, which I will promptly ignore. The ECB stated earlier in the week that the rates in that area will remain depressed for the foreseeable future, and the Non-Farm payroll numbers in America seem to be suggesting that the rates in the US are going higher. The Federal Reserve should begin to taper off of quantitative easing in September, and as a result I see rallies as selling opportunities.

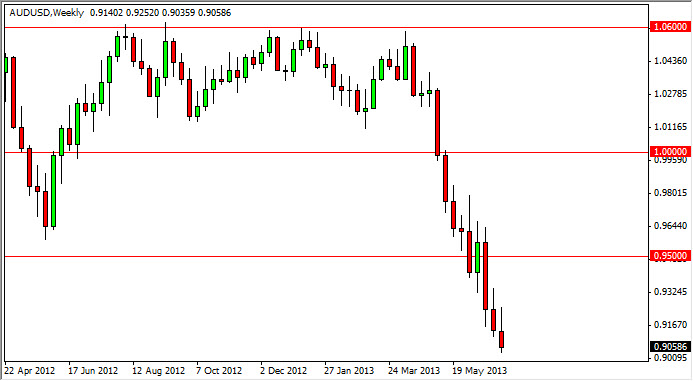

AUD/USD

The Aussie has absolutely been pummeled in general. The Aussie is highly leveraged to the Asian economy, and as long as the economies in that part of the world continue to struggle, the Aussie will as well. Of particular interest is the Tuesday CPI numbers coming out of Beijing. If they look weak again, this might be what we need to see the AUD/USD pair finally break below the 0.90 level.

That being said, any bounce from that area should be a selling opportunity in this market. The pair should continue to weaken, and quite frankly the Reserve Bank of Australia prefers that. I am not going to fight their desires.

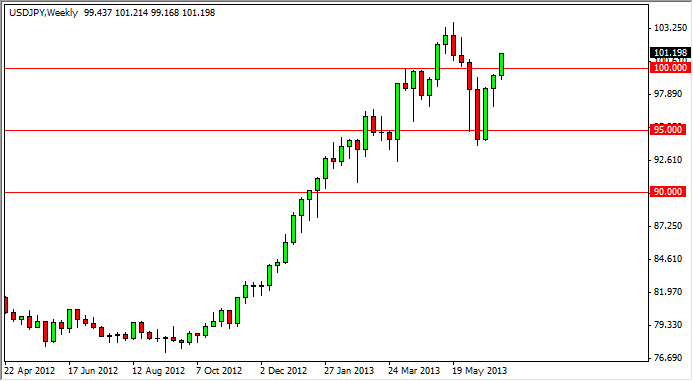

USD/JPY

The USD/JPY pair shot above the 101 level during the Friday session as the Non-Farm payroll numbers surprised to the upside. The interest rates in the US rose, and as a result money flowed from East to West again as the JGB’s continue to produce lower and lower rates in Japan. The markets will send money to where it is treated better, and that seems to be the USA at the moment. The breaking of the highs from the Friday session should produce another leg higher. On top of that, I believe that any move back to the 100 level should produce a lot of support as well.

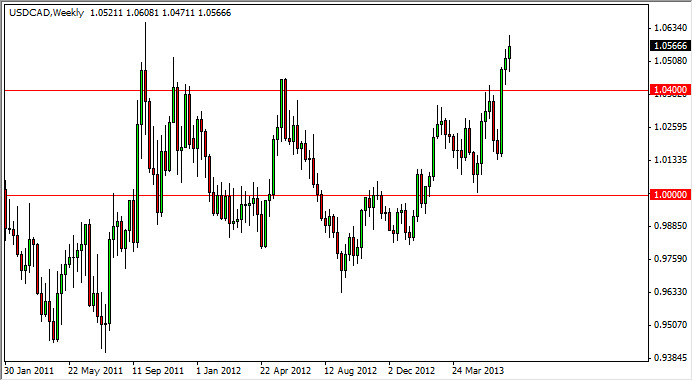

USD/CAD

For my money, this is the most interesting pair in Forex at the moment. I cannot help but notice that the oil markets are all spiking in reaction to the political crisis in Egypt, yet the Canadian dollar is ignored. This isn’t normal, and I believe that the currency markets have the story right. The oil markets have overreacted, and as a result I am getting ready to sell oil on the first signs of resistance, and buying this pair all the way up, as the fall in oil will only fuel the move higher in this market as well.