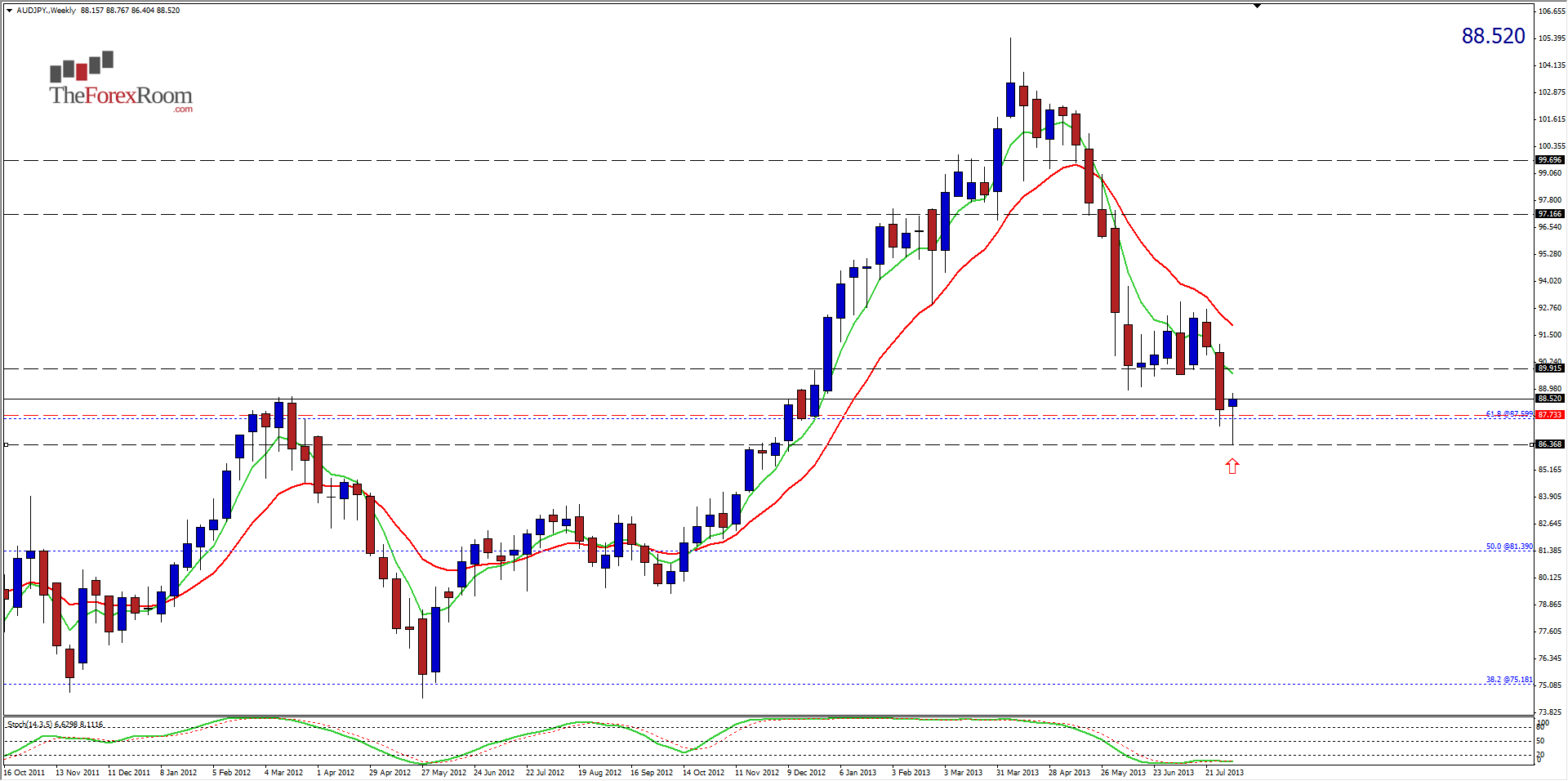

The Australian Dollar appears to be making a comeback against many of the major currencies of the world and the Japanese Yen is one of them that looks ripe for the upward momentum to capitalize on. Looking at the weekly chart we see that the pair printed a bullish Hammer, also known as a Pin Bar Reversal. The candle formed in the lower third of the previous week’s range which if you know this pattern at all, you know that this is the optimal position for the formation. Last week’s low kissed the 61.8% Fibo retracement level for calculated from the June 2012 low at 74.49 to the 2013 high at 105.42. The pair also tested, and so far rejected the support level at 88.00 which has been a key level for the pair numerous times in the past. The pair broke the former support level at 99.00 only 2 weeks ago and this may just be the pair re-testing this area as resistance now, as it took 8 weeks for the pair to break through this area on the bearish run. If we do get back above 90.00, there is all kinds of room to the upside with 93.50 and 97.00 being the most obvious targets. Happy Trading!

AUD/JPY Weekly Hammer

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- AUD/JPY