By: DailyForex.com

My last analysis of this pair was almost one month ago. I ended it with this prediction on the morning of 24th July:

In trying to see what will happen next, how today's daily bar forms will be crucial. The more of the following levels it closes below at midnight GMT tonight, the more bearish the outlook:

1. Yesterday's open at 0.9256.

2. The upper trend line of the bearish channel and the resistance/support level at 0.9248.

3. The weekly open at 0.9175.

If 1 and 2 happen, it should be safe to turn bearish and look for short trades, targeting all the way down to 0.9034.

The daily candle actually closed that night at 0.9131, passing all three of the levels I mentioned and giving a very bearish outlook. Although the price turned up during the next two days, it then bounced off the upper trendline and went straight down all the way to 0.8847, easily meeting my recommendation for shorts down to 0.9034.

Looking to the future, we can wait until September before we need another look at the monthly chart, so let's begin with the weekly:

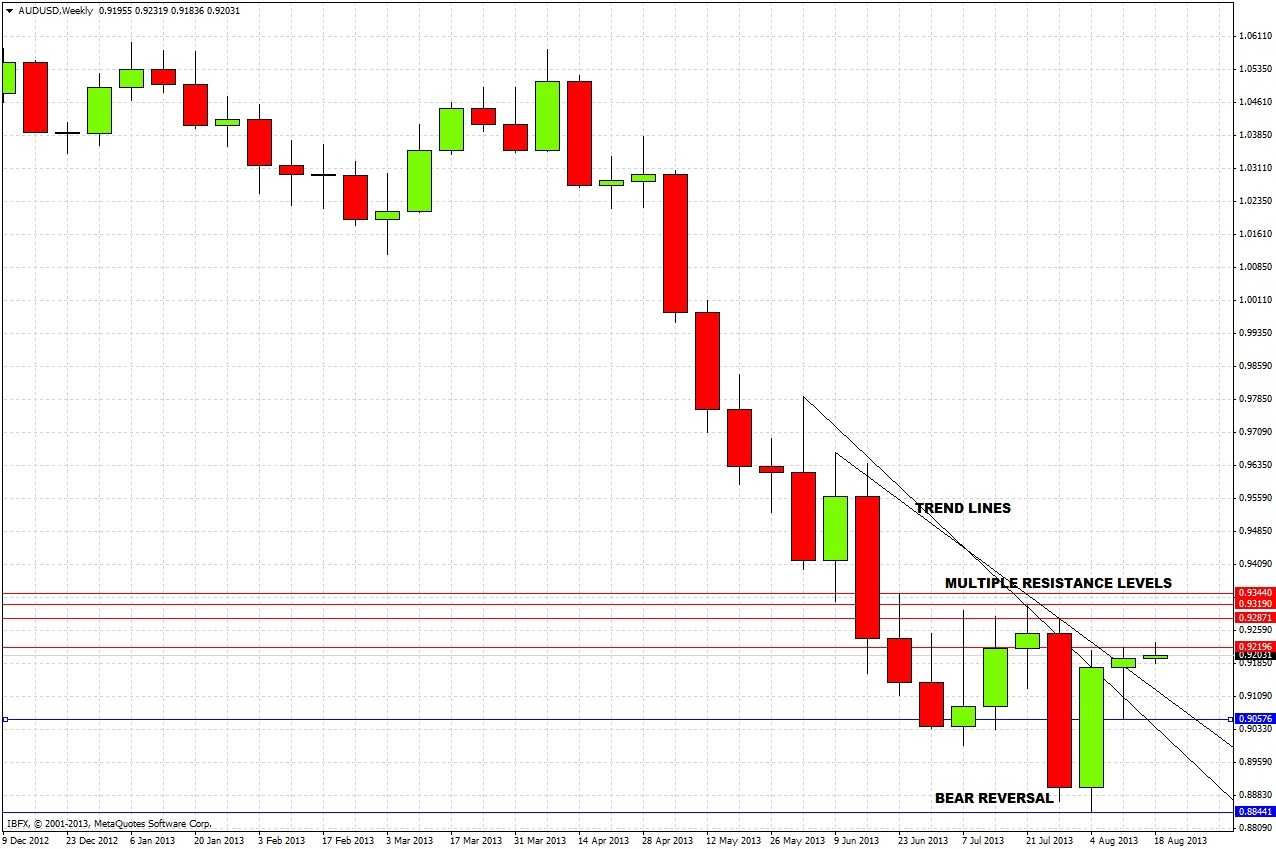

The week following my last analysis formed a strongly bearish reversal candle off the trendline. Although this was broken to the downside during the following week, there was a strong recovery, and the action has been bullish ever since, although slowing now as we are testing a zone of resistance overhead formed by the highs of the last two candles at around 0.9220. Despite the slowing, both the long-term trend lines have been broken to the upside, although not strongly, and there is a great deal of resistance overhead. Let's drill down to the daily chart for a closer look:

We can see that the price was rejected from the upper trend line, but finally managed to break through at the end of last week with a bullish reversal candle. The RSI(14) has crossed up above 50. However the overhead resistance at 0.9220 is holding so far.

The signs are bullish, but the strong resistance overhead is going to take more momentum to be broken. If there is a bearish reversal off any of the points of resistance overhead, it could be possible to take a short off that, especially if the support level of 0.9057 and the broken trend lines are converging, as they are at the moment. The trend lines would be a good target to take profit at any short. This would also be a good area to go long if there is a strongly bullish bounce there.

It will not be safe to take a really decisive long until 0.9344 is decisively broken to the upside. Nor will it be safe to take a really decisive short until 0.9057 is decisively broken to the downside. Until either of these events happen, be cautious and conservative in trading this pair, and keep a bullish bias.