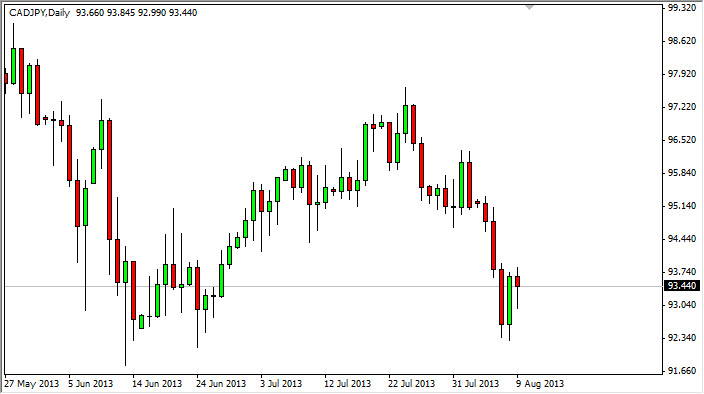

The CAD/JPY pair fell during the session on Friday, but as you can see found enough support at the 93 handle in order to bounce and form a hammer. This is in stark contrast to the most major yen related pair, the USD/JPY market. However, it has to be said that the Canadian dollar is starting to pick up some steam, and this is more than likely being driven by the oil markets. With that being the case, it's not a big surprise to me that we got the supportive hammer that we did for the Friday session.

I believe that if we break the top of the Friday highs, that this market will in fact head towards 95 or so. They could even go higher than that, but I see a bit of resistance there. I think of this more like a short-term trade, which of course has a lot to do with the fact that we are in the middle of the summer.

Oil has a massive effect on this market

One of the things about this market that makes it interesting is the fact that it is so heavily influenced by oil most of the time. After all, Canada is a net exporter of oil while Japan imports all of its fuel. Because of this, as oil markets rise, typically this pair will as well. The oil markets do look like they're getting ready to try and breakout, and if that happens it would not surprise me at all to see this market start moving up also.

As far as selling is concerned, it's at least impossible to do so at this point in time because there is so much support down near the 92 handle. That being the case, I'm simply waiting for the buying opportunity which I think has shown itself in the form of the Friday candle, in order to pick up a few hundred pips. I don't necessarily think are looking at the beginning of some massive long-term move higher, but certainly a bounce is probably a reasonable thing to expect at this point.