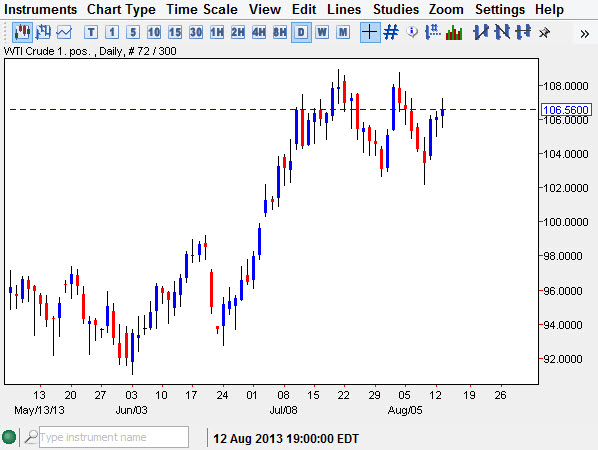

The WTI Crude Oil markets went back and forth during the session on Tuesday, but as you can see essentially got nowhere in the end. On top of that, I see this market as being stuck between $103 on the bottom, and $109 on the top. That being the case, we are simply in "no man's land", and as a result I have absolutely no interest in buying this market right now. In fact, I think the rest of the summer is going to be a very bad for this market unless of course you are a scalper.

The Federal Reserve and its quantitative easing questions are the only thing that people care about at the moment, and the lack of volume certainly isn't helping the situation. Quite frankly only the completely daft are pouring money into the oil markets at the moment and looking for longer-term moves at the moment. If you are finding yourself trying to play a longer-term move going forward, you are essentially gambling on what the Federal Reserve may or may not do. That is not trading, that simply throwing money down a hole, something that I have waited all costs.

Range bound until September

There are ways to play this market in the options pits, but quite frankly I feel that we are essentially range bound until at least the first week of September. There will be headlines across the wires that suggests what the Federal Reserve may or may not do, but at the end of the day until we actually know it is simply going to be a lot of drama and even more noise. Going forward, it's very easy to imagine a scenario where the markets are range bound between now and that announcement, so if you are a short-term trader it's very possible to make a few dollars here and there. However, as they tend to try to play more of a swing trader role, I will simply be on the sidelines until we get some type of affirmative announcement in one direction or the other.