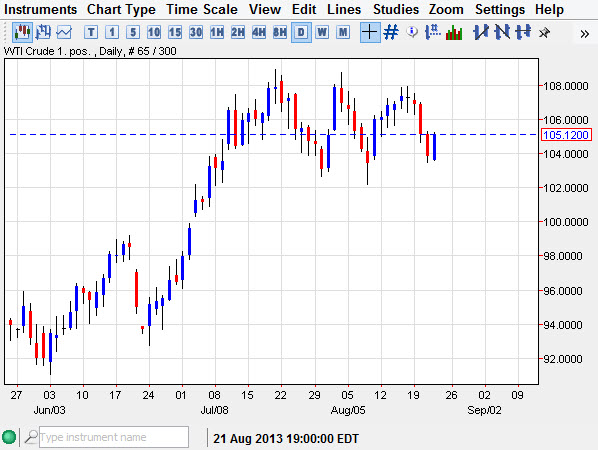

The WTI Crude Oil markets rose during the session on Thursday, as you can see bouncing off of the lower portion of the consolidation area that we've been in for some time. I think this is a fairly reasonably expected move, simply because there is absolutely nothing out there right now to move the oil markets in general. With that being said, I'm not overly impressed one way or the other but do recognize the fact that we have a market that can be traded back and forth. With that being the case, short-term traders should relish this type of opportunity going forward.

I don't think that there is anything that's going to move this market until we get to the month of September. Simply put, the world is worried about the Federal Reserve and whether or not they are going to taper off of quantitative easing, not necessarily the supply and demand equation when it comes to oil. Granted, that does have something to do with the price of oil, but these days very little.

The Federal Reserve still holds the keys

Quite frankly, I'm bored typing this every day. However, I cannot stress enough how the tapering in September or October, or for that matter the lack of, will produce the next move in the oil markets. Remember, the WTI Crude Oil market isn't necessarily subject to problems in Egypt, unlike the Brent market. Because of that, it will lag point forward as there are many stressors in the Middle East right now moving the other markets.

Quite frankly, I believe that this market could get a little bit of a bid simply because some refineries may choose used of UTI instead of Brent if there is serious amounts of trouble. However, I believe this all comes down to the US dollar, and what the Federal Reserve does in the end. Because of this, I fully expect the $108.50 area to keep this market under wraps, as well as the $103 level to keep it somewhat boosted between now and whenever we find out what the Fed is going to do.