The EUR/CHF pair has been essentially broken for ages. This is because of the Swiss National Bank, and their decision to put a "floor" in this pair at 1.20 several months back. That being the case though, it does give us some trading opportunities in the short term occasionally, and that's what I'm seeing in the charts right now.

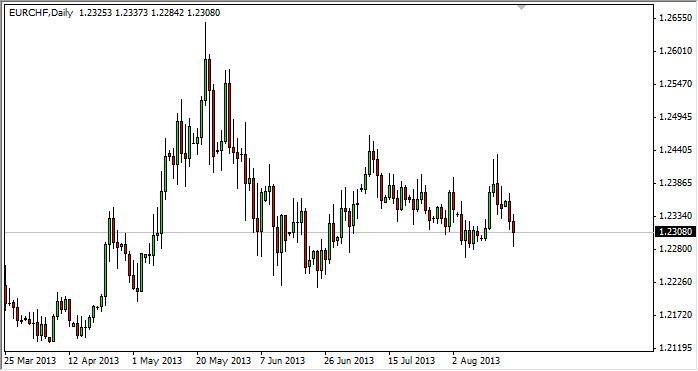

As you look at the chart accompanying this article, you can see that a hammer has formed right at the 1.23 handle, a natural place to see support come into the market. While I do not expect to see a massive move higher, I do think that there is probably about 100 pips to be had if you are willing to buy at this point in time. Granted, it could be a very choppy affair, but in the end it would simply be continuing the consolidation that we've seen all summer long. After all, this is the time of year where traders simply do not take on larger position, and they are simply adjusting back and forth. It would not surprise me at all if there are some larger traders out there scalping this pair to simply boost their numbers for the end of the year.

Swiss National Bank

Keep an eye on the Swiss National Bank, although they have recently been fairly quiet, they can and will sometimes complain about the value the Euro against the Frank. It's been a while, but there's always things coming out of Switzerland that can move this pair. Quite frankly, we know that the situation in Europe is getting better as the Europeans are exiting a recession, but ultimately this pair has essentially been forgotten by a lot of the traders out there, and as a result it may offer random trading opportunities like this for the foreseeable future. So then you have to ask yourself this question: Are you trading for excitement, or are you trading for profit? This is the type of trade that doesn't seem very exciting or sexy, but enough of these can make a very strong year.