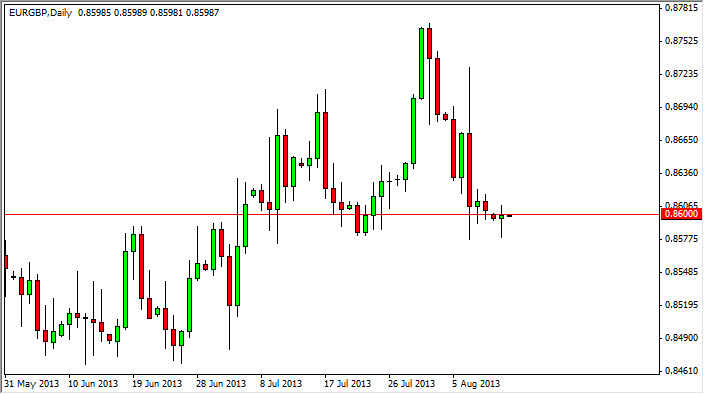

The EUR/GBP pair fell initially during the session on Monday, but as you can see found enough support near the 0.8575 level in order to bounce and form a hammer that seems to be centered on the 0.86 handle. This of course is an area that has been supportive in the past, although a bit "squishy."

That being the case, I think that we have a nice set up for a short-term long in this currency pair. After all, we have been making a higher and higher resistance area for the consolidation, almost in the form of an inverted triangle. That normally means that we are going to continue much higher, and eventually breakout to the upside.

The Euro look strong at the moment against the US dollar, but quite frankly the British pound isn't doing that bad either. This is a relative play, remember it only needs the Euro to be stronger than the Pound overall in order to work. Obviously, there is a ton of support just below, so a break above the 0.8625 level is enough to have me start buying again. I don't look for some type of long-term move, I think we will simply go back to roughly 0.8750 or so comfortably. Whether or not we get above there is an another issue, but in the end I don't really care - this is a short-term trade. We are in the dead of summer, and sometimes this is about as good as it gets.

Liquidity issues

Speaking of the summer, remember the liquidity just isn't there, so there is a gap so be somewhat careful. When looking at this chart I really don't see how this going to breakdown with any significance unless something specific to the Euro happens. It would have to be some type of headline issue that we do not see coming yet, and quite frankly this is not the time of the year you see a lot of news. That being said, I get this feeling that I will be long of this pair in the next couple of days, and aiming for about 150 gain. Not a bad deal at all considering it's in the middle of the summer.