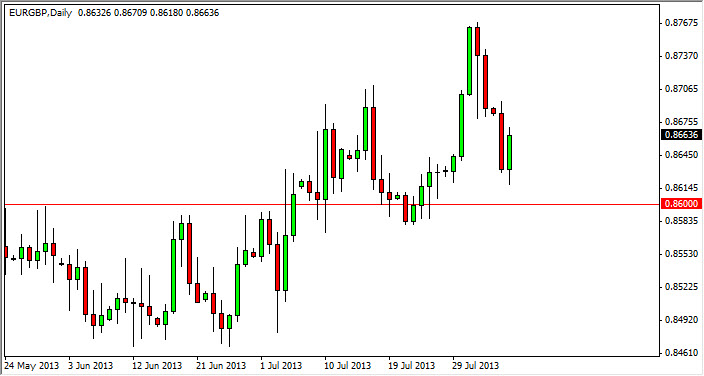

The EUR/GBP pair rose during the session on Tuesday, after bouncing just above the 0.86 handle. That being the case it looks like the pair is going to respect what looks like a minor channel, and perhaps grind higher from this point on. I do not expect any type of massive move, and quite frankly this is one of the most annoying pairs in the world of Forex to me. This is because there is no fluidity to the moves most of the time. It is a very choppy market simply because the two economies are so interdependent. This is much like the USD/CAD pair at times.

However, it does look like a bounce is coming. If you are shorter-term trader then certainly you can take advantage of this. The longer-term trader of course will struggle with it simply because there is so much noise in the meantime.

There are other ways to play this pair, and other ways to use it

You can play this pair against the US dollar. What I mean is that you can trade the Euro against the Dollar, or the Pound against the Dollar. You can use this chart to determine which one of the two currencies is stronger than the other one. According to this chart, the Euro is stronger than the Pound. This is why the Euro should outperform the Pound against the US dollar. It's a technique that I use quite a bit called "triangulation” that simply looks at three currencies and tries to determine which one you want to own, and which one you want to sell. Most of the time, the Euro and the Pound will move in the same direction against the Dollar, so now you are just simply picking the stronger of the two and going with it. Or, if you are looking to sell and buy the Dollar, you're selling the weaker of the two.

In fact, that is about 90% of the use for this Forex market that I have. I often use it as a tertiary indicator, when I'm deciding what to do about European currencies.