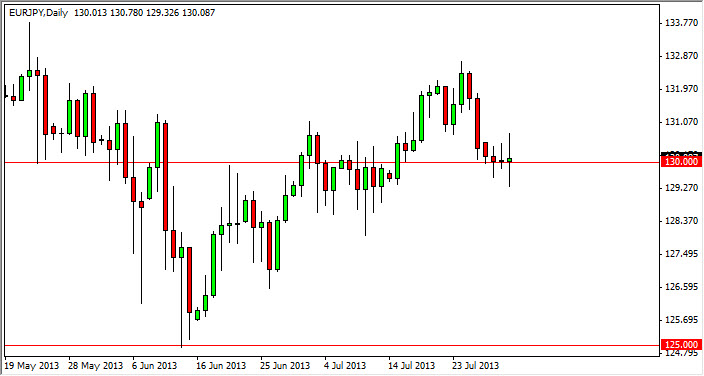

The EUR/JPY pair went back and forth during the session on Wednesday, mainly in reaction to the Federal Reserve and its minutes being released. That being the case, I feel that this market is essentially trying to figure out what's going on, and is certainly attracted to the 130 handle. Going forward, I do believe that this market will eventually be bullish again, so a break of the highs for me is a good sign and would have me buying. As far as selling is concerned, that is a completely different story.

Selling is going to be almost impossible simply because of the Bank of Japan and its dealings with the Yen. On a break below the 128 handle, I believe that we could get a bit of a fall, but quite frankly the 125 handle is probably a bit too much to overcome by the sellers. That being the case, it simply a matter of either breaking out above the top of the range for the Wednesday session, or falling and finding some type of supportive candle. Either one of the signals work for me, and quite frankly I'm just as comfortable taking one as the other.

I still think 133 will happen soon

I still believe that the 133 handle will happen fairly soon, and as a result I think that buyers will flood the market over the next several sessions. Whether or not we can get out of this malaise this week might be a different question, but the closer we get to larger traders returning from vacation, the higher the odds are that we do in my opinion.

That being said, I actually prefer to buy a pullback. After all, you are selling the Yen at a higher rate, and buying the Euro at a lower one. The give it is is a "value play", showing that the markets want to go higher, but there is still plenty of uncertainty out there to throw them around. That's been the case for quite some time now, so this should not be much of a surprise.