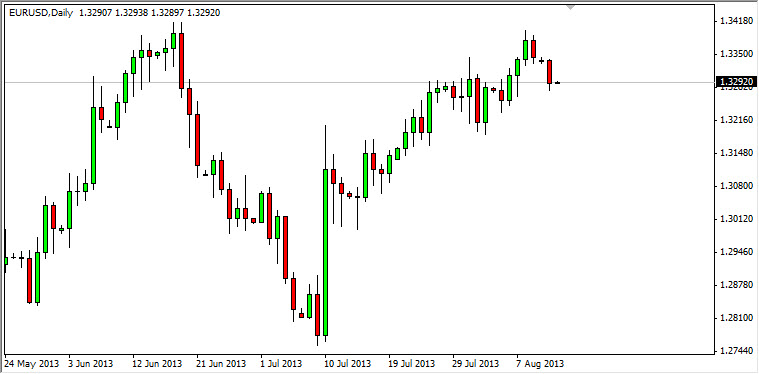

The EUR/USD pair fell during the session on Monday as you can see, breaking below the 1.33 handle. That being said, there is a significant amount of support just below and I feel that this market is probably best avoided at this point in time. Certainly you can't sell it, as there seems to be a lot of noise below, and that will more than likely have an effect on any selling that we try to do.

Nonetheless, I don't necessarily want to buy it either simply because I think there is quite a bit of noise above as well. The 1.34 level is an area that needs to be overcome in order for the buyers to really take control, and this time of summer is not very conducive for something like that to happen. On top of that, you have the Federal Reserve and whether or not they’re going to bother tapering off, or whatever it is that they plan on doing. Quite frankly, the Federal Reserve has no idea what it is going to do and it's obvious. With that being the case you have a recipe for stagnation at best.

Headline driven, and there aren't many headlines.

There's really nothing to push the markets around at the moment, although Europe seems to be leaving a recession finally. That being said though, people don't care about that, they care about the Federal Reserve. Because of this, I have been basically ignoring this pair except to check at the end of the day in order to see whether or not something significant has happened. This time of year that's almost going to be impossible, especially considering everybody is waiting to see whether or not the Fed does anything in the month of September. If they do, that will be very strong for the US dollar, and if they don't the Euro will take off. Quite frankly, it's a binary trade and there's nothing in between. We will have to wait and see what happens, but in the meantime we will more than likely see a market that's short-term trading only, and quite frankly not that interesting.