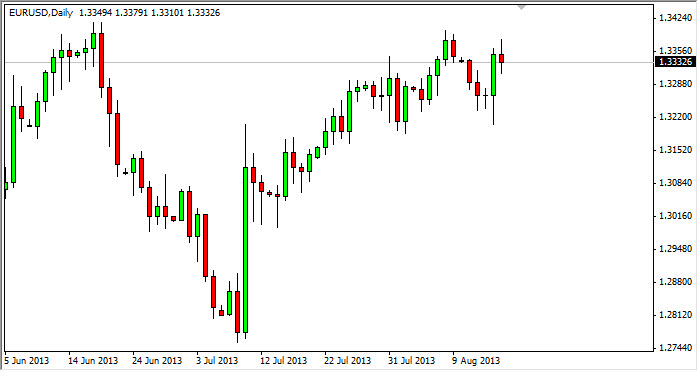

The EUR/USD pair tried to rally during the session on Friday, but as you can see failed and formed something along the lines of the shooting star. This is at the top of the recent consolidation area that has a slightly upward tilt, so it doesn't surprise me that we might see a little bit of a pullback from here. After all, we are towards the end of the summertime, which is traditionally very illiquid in the currency markets. In other words, most of the big money simply isn't there to push the market around, so it makes sense we do very little.

That being said, the weekly chart did form a hammer and it looks like it's trying to breakout above the 1.34 handle. A move above that level to me is a massive breakout and sign of things being calm. With the Federal Reserve and its tapering prospects on the forefront of most traders’ minds right now, it makes sense that this pair will be held hostage just a little bit. However, there are always people looking to "get in front of the move", and as a result there are certainly people out there betting in both directions.

Certainty won't be here until September

Unfortunately, certainty won't come into the marketplace until September. This is when we should start to see more official news when it comes to the idea of the Federal Reserve tapering off of quantitative easing. Until then, it's simple speculation which of course can be disastrous if you're wrong. That being the case, I have stayed out of the market for the most part but I do recognize the fact that we are in a little bit of a range right now, so the short-term trader might be able to sell here looking for a slight pullback. All things being equal though, the longer-term charts line up with a buy position, not a sell one. So quite frankly it's probably easier just to buy down towards the bottom of the range closer to the 1.3225 level or so.