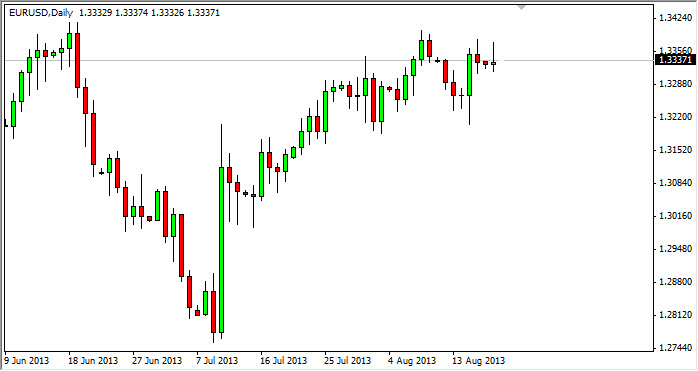

The EUR/USD pair tried to rally during the session on Monday, but as you can see met quite a bit of resistance and actually pulled back to form a shooting star. This shooting star of course is a negative sign, but I'm not necessarily looking for any type of meltdown anytime soon. Quite the contrary, I believe this simply shows us that this market is still going to go sideways and that makes complete sense at this point in time. After all, it is late August, a time when most large traders are away on holiday and not worried about the currency markets.

On top of that, everybody knows of the Federal Reserve will be making some type of announcement soon regarding whether or not they are going to taper off of quantitative easing during the month of September or October. If they do not, expect the pair to go much higher as the US dollar loses strength. On the other hand, if they do decide to taper off, that will be very Dollar supportive, and as a result we should see this pair absolutely crumble.

Two levels to watch

The 1.34 level on the upside is a level that I am watching see whether or not we can break out of. If we do, I think this market goes much higher and we will not only see the 1.35 level, but probably the 1.40 level eventually. On the other hand, I think that if we managed to break down below the 1.32 handle, we will eventually hit 1.28 and possibly even lower than that. This of course is going to be predicated upon whatever the Federal Reserve does, and until then we have no way of knowing what's going to happen in the long run.

Between now and then though, I think we are simply going to bounce around in this general vicinity that we find ourselves in, and therefore this is a short-term traders market. As far as making some type of longer-term trade, you probably will not be able to do that until sometime in September.