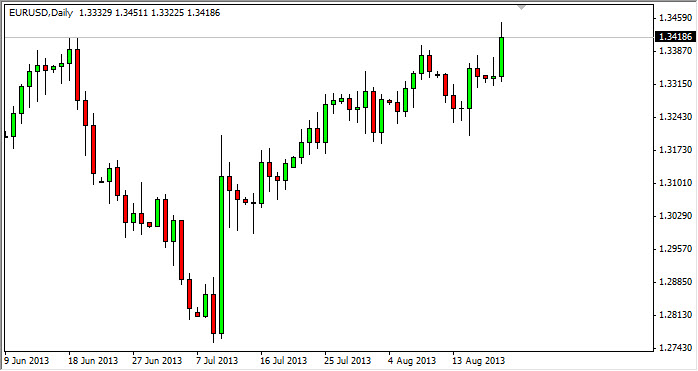

The EUR/USD pair rose during the session on Tuesday, breaking above the 1.34 level, an area that I've been calling for in order to start buying. Because of this, I now believe that a break above the highs for the session on Tuesday is more than enough reason to start buying. Granted, I fully expect the 1.35 level to cause some type of resistance based solely upon the large round psychological nature of the number, but in the end I think that we will eventually go higher than that because we have broken above some major resistance recently.

It appears to me that the markets are betting the Federal Reserve will not be able to taper off of quantitative easing during the month of September or October, and as a result the Euro should be the beneficiary as the US dollar gets pummeled. After all, it is considered the "anti-dollar", and as a result the Euro always does well in the situations.

Beware of headlines

Be aware the fact that headlines can come out of members of the Federal Reserve or other such entities any time that will move this pair. Also, you have to keep in mind that we are at the end of summer, a time that typically has very little in the way of liquidity as large traders are away at the beach, and not particularly concerned about the currency markets at the moment. Because of that, sudden moves could happen at the drop of a hat.

Ultimately though, I think that the Federal Reserve will set the tone for this pair that should last well into 2014. The Europeans have just gotten out of a recession, so that of course is positive for the Euro, but ultimately it's the Federal Reserve that is pulling the strings in this particular marketplace. This is going to be true with all dollar related currency pairs, but this one will be especially sensitive to it as it is the most widely traded market on the planet Earth.