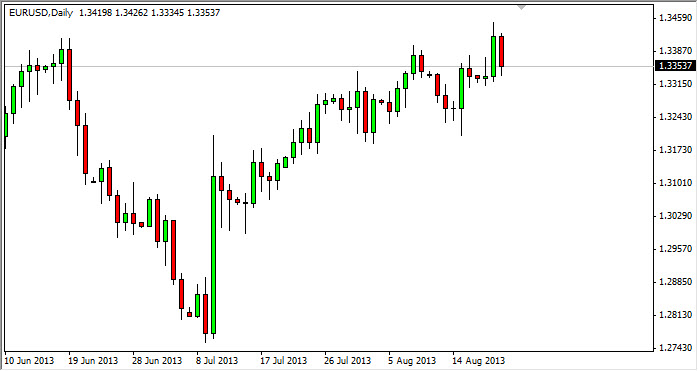

The EUR/USD pair fell during the session on Wednesday, as the Federal Reserve released minutes from the last meeting suggesting that many of the members were on board with Ben Bernanke’s timeline of quantitative easing being tapered off of. The markets now are trying to brace themselves for the idea of less QE coming in either September or October, and as a result the US dollar got a bit of a boost for the session. However, you can see that we are starting to head towards support, so we don't necessarily have a breakdown that's something that can be sold at this moment.

Nonetheless, this is an important tell towards the future. If that's the case, I feel that the US dollar will strengthen over time, and the Euro will probably suffer the most against it. While it is true that the Europeans are just now exiting a recession, the reality is that the US dollar will have gained strength against most currencies around the world, and the most liquid and well traded financial instrument in the world is this currency pair. That's why it will show up so drastically in this marketplace.

Keep an eye on the Federal Reserve, everybody else is.

Given an eye on the Federal Reserve will be absolutely vital over the next several weeks. I believe that the next move will be the one that influences this pair for the next six months for the very least, and possibly the next several years. After all, if we have one central bank that is tightening, and another one that remains fairly loose, it makes sense that markets will move in one particular direction or the other.

I believe that a break down below the 1.32 handle is the signal that the US dollar is going to gain massively, and we will see a move back down to the 1.28 handle, and possibly lower. If the Federal Reserve does in fact taper off of quantitative easing we could see a break down below 1.28 that could move this back down to 1.25 before the move is all said and done. However, if the Fed does not taper, this pair will certainly explode to the upside.