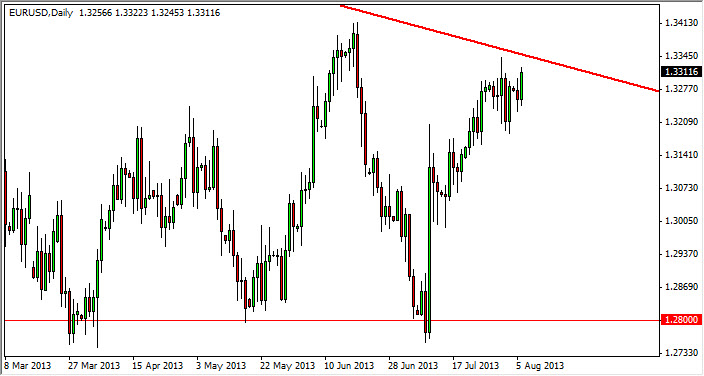

The EUR/USD pair rose during the session on Tuesday, but as you can see still remains below the downtrend line that I have been watching. The downtrend line of course is the top of the descending triangle of the larger time frames, and as a result if we do manage to break above it would be a significant breakout. At that point time, we would more than likely be ready to go much higher, and perhaps start a new uptrend. However, we could not get above that downtrend line yet again and as a result I believe that we are still stuck in this range.

If we can get above the 1.3350 level on a daily close, I think that would be close enough for me to start buying. On the other hand, if we close below the 1.32 handle on the daily close, we are probably broken down and I think we could grind our way all the way down to the 1.28 level. That would be a longer-term move, and certainly not something that would happen over the course of the next several days. This would be something that would take weeks, and it would be more of a longer-term trader’s type of move.

The Federal Reserve is the only game in town

The Federal Reserve is the only game in town right now, as the markets wants to see whether or not they are going to taper off of quantitative easing in either the month of September or October. If they do, they'll undoubtedly be the catalyst to smash through the support in this pair. Right now, we are in the dead of summer and a lot of the larger traders are simply not there. This is why it doesn't surprise me that we don't have a whole lot of action in this pair, and quite frankly I don't expect to see any in the short term. However, once we get a decent move, it should be obvious and it should be drastic. That could be the trade of the year given the right circumstances.