By: DailyForex.com

Last Monday I forecast that:

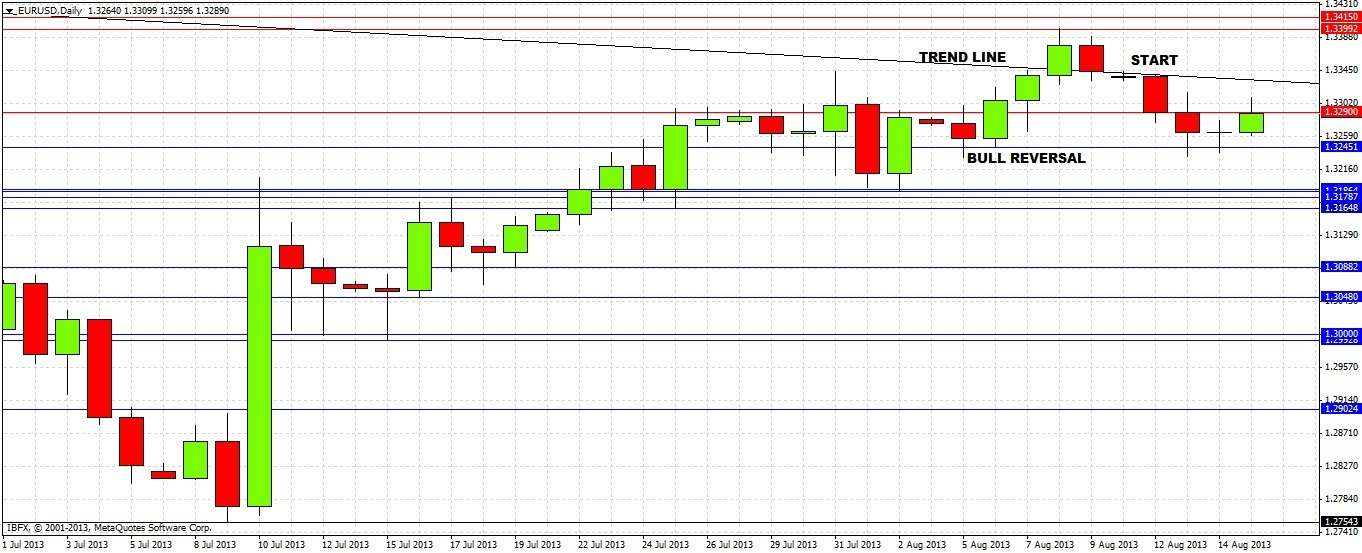

This pair is in the balance, and what happens next should provide a good clue as to whether we are going up to 1.37 or down back to 1.31 and below. If we get a daily close above the trend line we are going back up to at least 1.34. If we get a daily close above 1.34, we are going up to around 1.37.

On the other hand, a daily close below 1.3322 is a bearish sign, and a daily close below 1.3245 will signify a move down to 1.3165 at least.

That day's close was at 1.3290, and the price did move bearishly down to 1.3245 the day after that. However we were unable to get a daily close below that level, and the price has been moving up again during the Tokyo session, returning close to 1.33:

The higher time frame charts do not have anything new to tell us yet, all the relevant developments have occurred in the daily chart shown above.

The level of 1.3245 held as it was the low of the bullish reversal a few days ago, however this level held quite weakly. At the time of writing 1.3290 is acting as resistance again and holding. Above that is the bearish trend line.

The difficulty in trading this pair is that it currently feels quite dead. It has run out of steam and is just reacting weakly to support and resistance within narrow bands. In fact the forex market as a whole has been very quiet this week with below-average liquidity, we seem to be truly feeling the “August effect” despite that fact that statistically it does not exist on this pair.

So, as there have been no really significant developments in price since my last analysis, the forecast I made then still holds for the future:

If we get a daily close above the trend line we are going back up to at least 1.34. If we get a daily close above 1.34, we are going up to around 1.37.

On the other hand.... a daily close below 1.3245 will signify a move down to 1.3165 at least.

Until one of these events happens, this is not going to be an attractive pair to trade, as it is moving within a small range and is devoid of life. It might be that we continue in the meantime to bounce weakly between minor support and resistance levels, so if you are determined to trade this pair you could try scalping off any of these levels or the trend line, until we get one of the developments I highlighted in italics above.

If we do get down to 1.3165, this is likely to act as quite strong support.