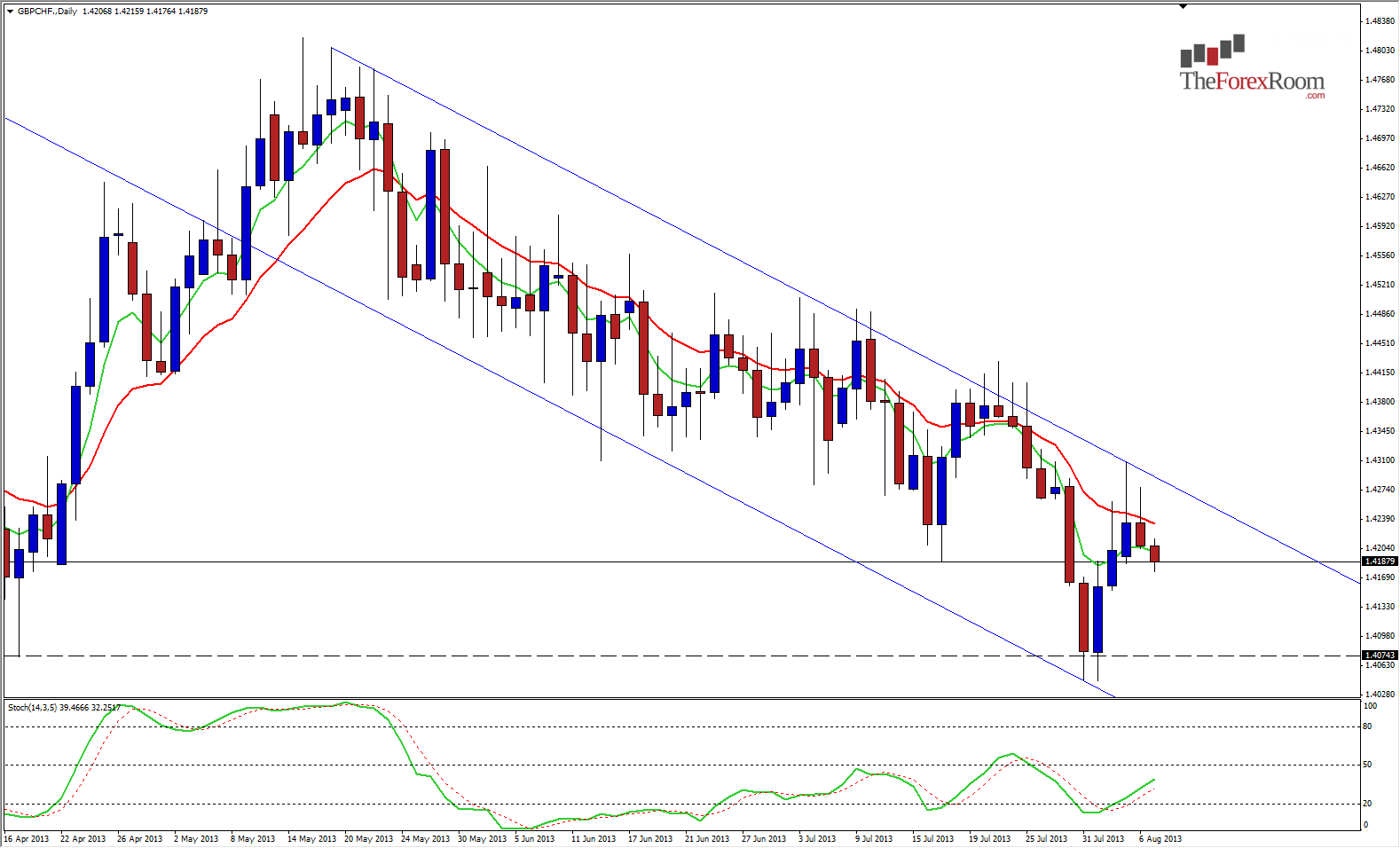

The GBP/CHF continues to remain bearish overall, in the grip of a 3+ month descending channel. Currently sitting on the Weekly Pivot at 1.4190 which was an area of Support & Resistance back in April, the pair seems poised to break this level after a bearish day yesterday. We tested the July lows on Monday and came relatively close to the top of the channel before descending again and never closing above the 13 Moving Average on the daily time frame. Minor support at 1.4160 will possibly give way after the London markets open, and then we have free fall potential to the Weekly S1 at 1.4060. For the past 3 months, the bears have only allowed the bulls short lived rallies and I expect nothing new at this point unless Mr. Carney creates some havoc later today with the BOE Inflation Report and Press Conference. Only if we were to see a Daily Close above the Monthly R1 and 62 EMA at 1.4375 would I even consider buying this pair, and the Weekly R1 sits in the way at 1.4325.

GBP/CHF Remains Bearish

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- GBP/CHF