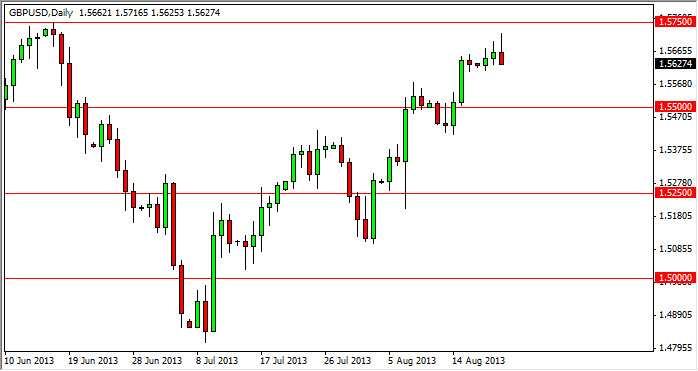

The GBP/USD pair tried to rally during the session on Wednesday, but as you can see by the time the day ended we saw the market fall apart, predominantly in reaction to the minutes coming out of the Federal Reserve that suggested that tapering it could very well be coming in September or October. That of course is US dollar positive, and as a result it gained strength against most currencies around the world, with the British pound of course being no different.

On top of that, I saw that this shooting star appeared just below the 1.5750 level, an area that I fully expect to see act as resistance. Because of that, I feel that we could be getting ready to see a fairly significant pullback which could either send this market much lower, or just proved to be a nice buying opportunity.

Watch the 1.55 handle

Watch the 1.55 handle if you want to know where this market is about to go. The reason for that is that is that the area has been so supportive and resistive over the past, I feel that there will be a lot of traders attracted to that price. If we can break below that level, I see aptly no reason why we will go down to the 1.50 handle over the course of time. If the Federal Reserve does in fact taper off of quantitative easing, I think that will be accelerated but of course we will know the true answer to that until the month of September.

On the other hand, if we find some type of supportive candle at that handle, I would be willing to buy and as it should send the market right back up to the 1.5750 level before it's all said and done. Expect a lot of volatility, quite frankly the currency markets are not only illiquid right now, but they also still have to wonder about the Federal Reserve and what it's going to do. Even though it appears that the session on Wednesday was pro-tapering, the fact is we still don't know conclusively yet.