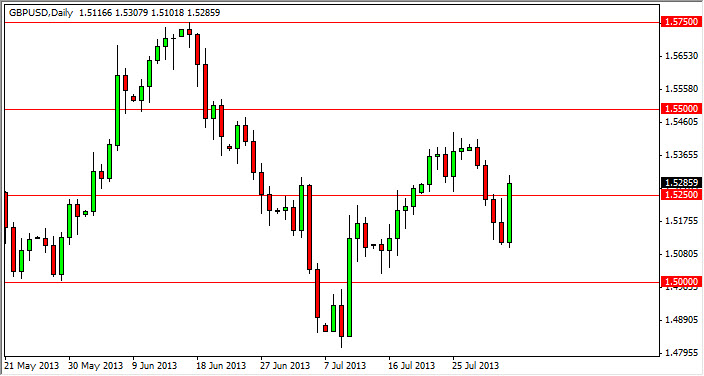

The GBP/USD pair rose during the session on Friday, smashing through the 1.5250 level, an area that had been expected to be significant resistance. While we didn't clear by awfully too much, it was enough to make me think that this pair is going to go higher from here. The candle from the Wednesday session of course is very strong it does send the signal as it broke the top of the shooting star as well as this resistance level, so that being the case I feel that this market is more than likely going to head towards the 1.54 level first, and then the 1.55 level shortly thereafter. Whether we can get beyond that might be a different question, but at the forefront of this movement seems to be significant momentum.

The British pound has enjoyed a strong session on Friday, but it has been pulling back lately as well. Because of this, we should probably expect to see a lot of volatility in the short term, as the markets continue to try and figure out what the Federal Reserve is going to do as far as tapering off of quantitative easing. In fact, this is going to be a theme amongst any currency pair that deals with the dollar, as traders try to figure out what the Federal Reserve will eventually end up doing.

The Federal Reserve is the only game in town

The Federal Reserve is the only game in town in the sense that their tapering policy is the one thing that traders care about at the moment. Beyond that, there are a lot of other things that could be going on but that is without a doubt the biggest driver of the Forex markets presently. This will be especially true when the larger traders come back from summer break, and we can expect to see large moves sooner or later. In the meantime though, we do not expect to see massive moves and that's why I believe that we are going somewhere around 1.54 or 1.55 just above if we do break higher.