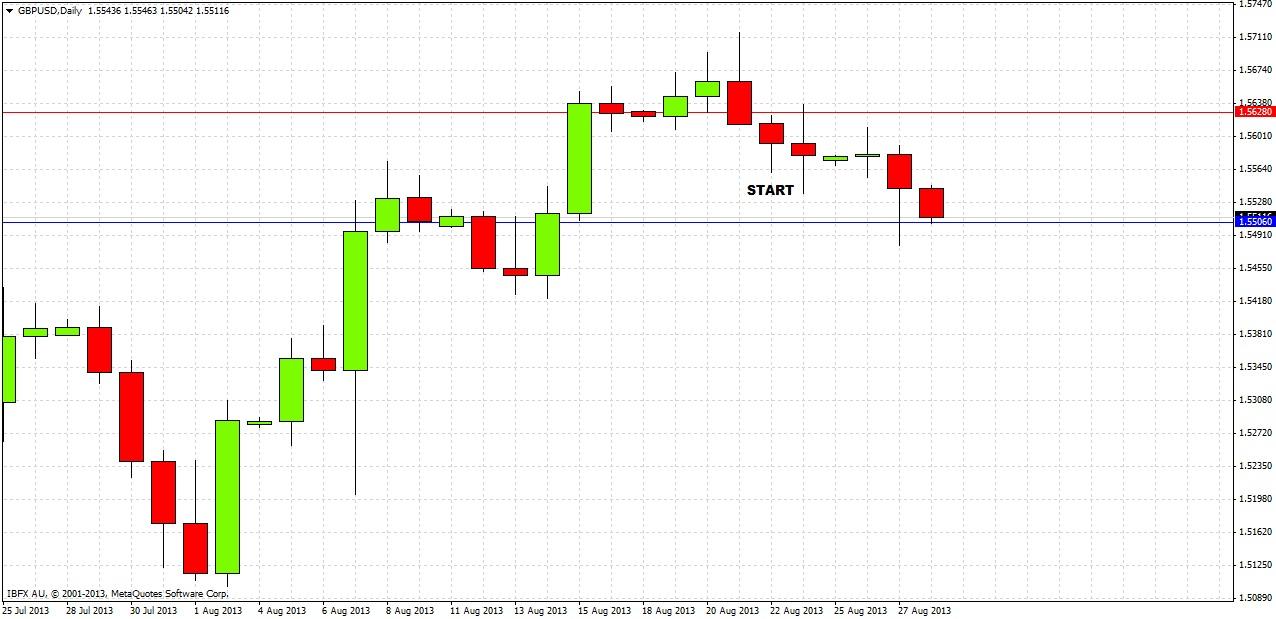

Last Thursday’s analysis ended with the following recommendations:

If these lines (1.5608 and 1.5628) hold this morning, we can expect to see a continued move down to around 1.5506. There would probably then be a continuation move down after some kind of bounce up….. Being short right now with a stop just above yesterday's high looks like a good trade if you can accommodate a stop loss in excess of a hundred pips and sit tight.

I am usually wary of turning bearish when there has been such strong bullish momentum so recently. However this pair can turn very quickly, unlike the EURUSD, which usually needs a few days to turn around. If you do go short, be cautious at the blue support levels, especially 1.5506.

This worked out very well. The same day there was a move up but 1.5628 was not broken to the upside, and there was over the following days a continuation move down that, following a bounce up, did reach 1.5506, so a short trade targeting that level would have been successful, as we can see from the daily chart below

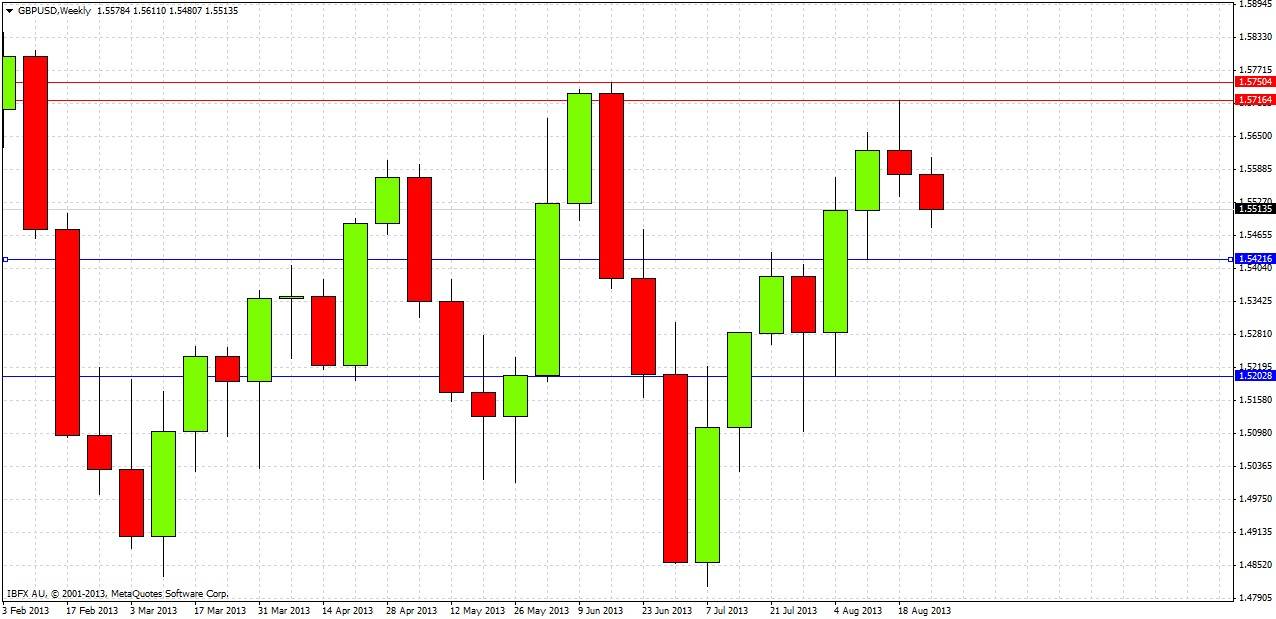

Looking to the future, let’s start by zooming out to the weekly chart

Last week’s candle was a bearish hammer, and this week’s action has been bearish so far. The next level of obvious support is at 1.5422 with a stronger support level below that at 1.5203, the low of the last reversal candle, which was bullish. There is a strong resistance zone overhead from 1.5716 to 1.5750.

The hammer candle does suggest a bearish bias, as although we have recent bullish momentum this pair can turn very easily. A closer look at the daily chart should reveal more:

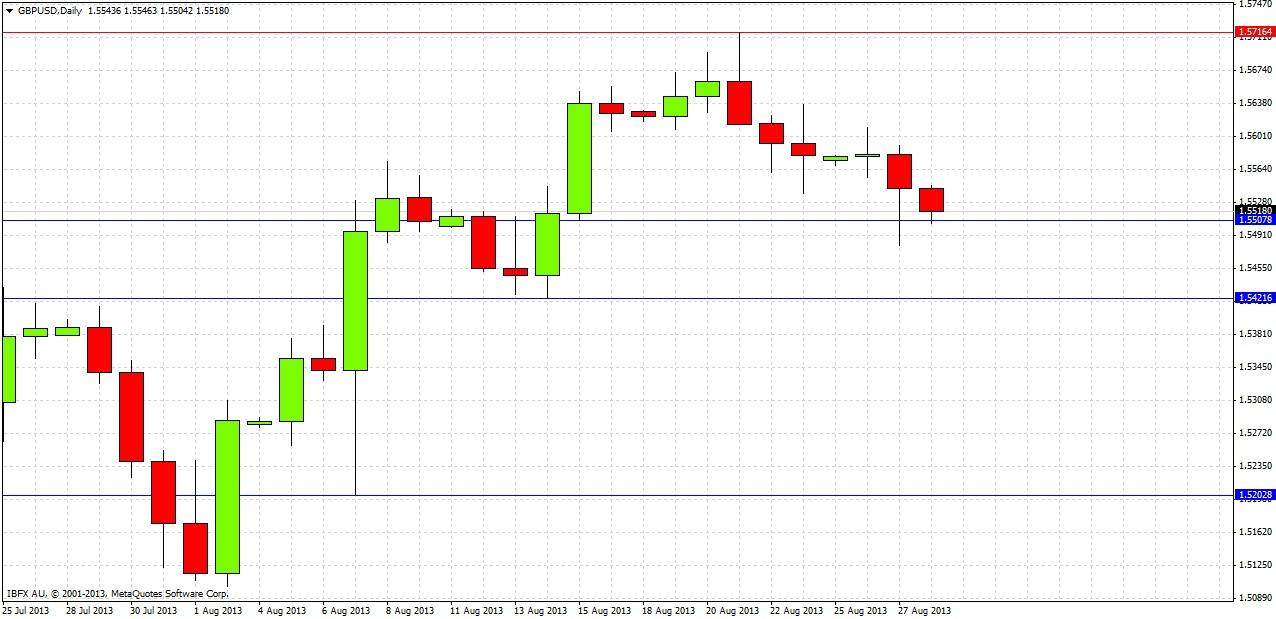

The bearish reversal candle at the high of the chart that printed last Wednesday is very significant. These hammer reversals on the daily chart are very predictive for this pair, and the price has fallen, it is now currently being held by support at the low of the last strongly bullish candle at 1.5508. A little later this morning, probably after publication of this piece, the Governor of the Bank of England will be speaking and his words could move the price strongly in any direction. Bearing this in mind and taking a wave approach to the daily chart, we have not seen yet as strong a move down as the previous bullish moves. This should make us cautious about being strongly bearish until after the Governor speaks, although the logical bias is still bearish.

The next key things to watch out for will be whether the support levels at 1.5508 and then 1.5422 break to the downside. If at least the first break does not happen soon, the bearish move is likely to be halted. Although we are at support, be cautious about going long now unless the Governor moves the market that way. Conversely, a bearish reversal after a move up to 1.5638 today could be a good opportunity for a short entry. If you are holding shorts, and have not already done so, it would be wise to take some profit now.

If we see a daily close below 1.5421, this is an indication that the price is likely to fall further. Beware of another support level at 1.5350 where there was strong buying following a sharp change in market sentiment about the GBP.