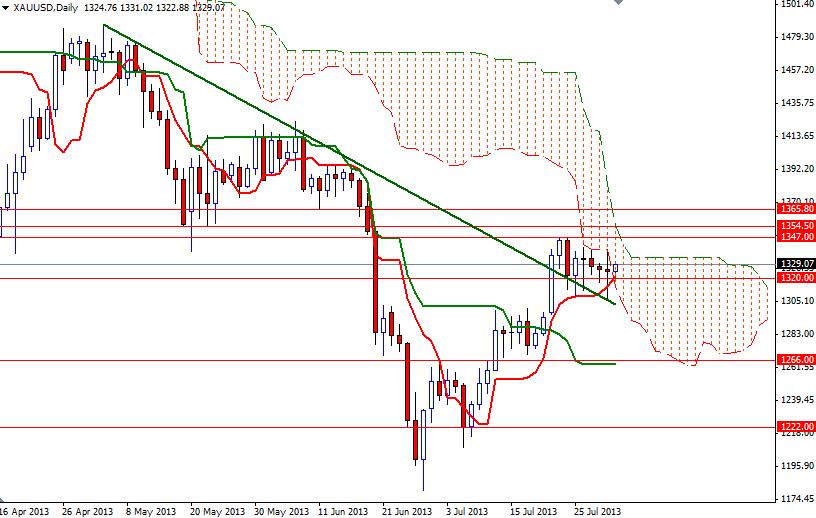

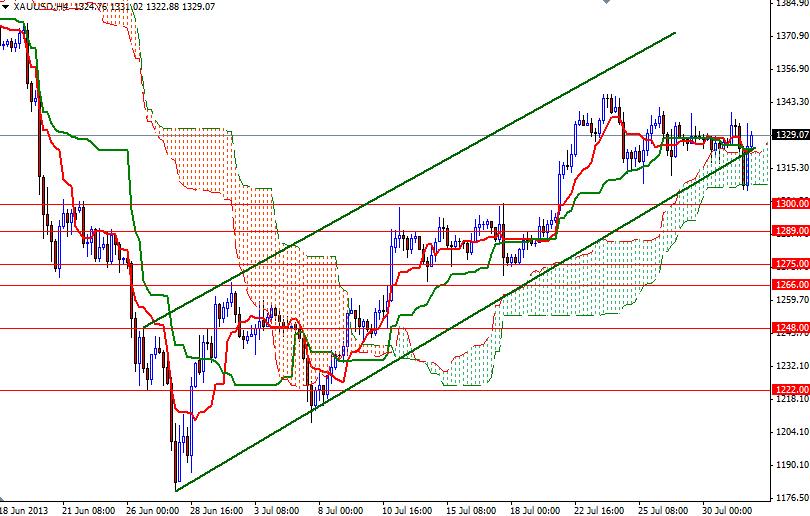

The XAU/USD pair closed lower than opening after a highly volatile trading session yesterday. The XAU/USD pair initially fell sharply and hit the 1306 level, which is the bottom of the Ichimoku cloud on 4-hour time frame, after the latest reports released from the Unite States provided further evidence that the world's biggest economy is continuing to recover. However, prices bounced back to the1334 level in the wake of the Federal Reserve’s announcement. The ADP Research Institute said private sector added 200K employees in July, higher than expectation of 179K and the MNI reported that its business barometer increased to 52.3 from 51.6. Data released by the Commerce Department showed that U.S. economy grew at a 1.7% annualized rate after a 1.1% percent gain in the first quarter. Fed policy makers said that they decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. Since the Federal Reserve continues to try to talk down the fears of a premature taper, I think we will have to wait for the September 17-18 meeting when FOMC members will update their forecasts for the growth, unemployment and inflation. If we continue to see some strong data matching Fed's forecasts, expectations that the quantitative easing program will be scaled back could weigh on the market again. From a technical perspective, the bulls will be having hard time to gain more traction while prices are below Ichimoku clouds on the daily chart and similarly the bears will be struggling to regain their strength as long as prices trade above the cloud on the 4-hour time frame. Because of that I still think the 1347 and 1300 levels will a have significant role in the market. If the bulls successfully push price above 1347, there is a possibility that we can visit 1354.50 and 1365.80. However, if the bears increase the downward pressure and pull the pair below 1300, I will be looking for 1275, 1266. A close below 1266 would suggest that 1248 will be the next stop.

Gold Price Analysis - August 1, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Read more articles by Alp Kocak- Labels

- Gold