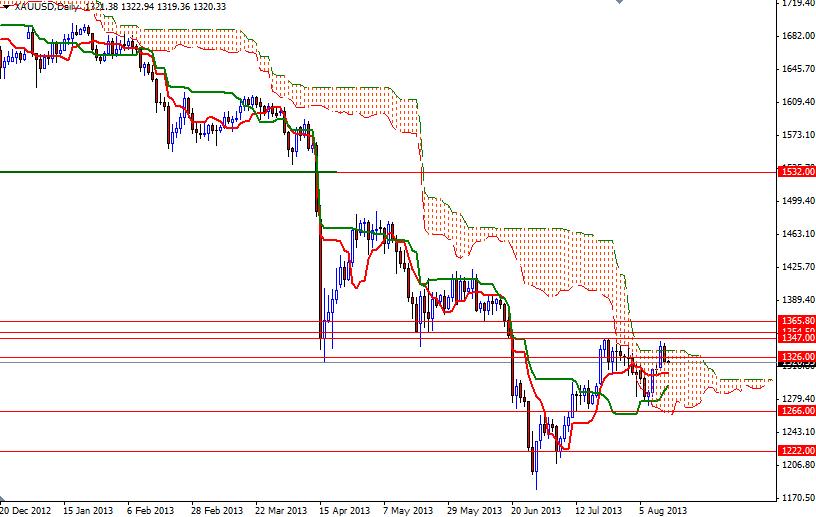

Gold gave up some of its recent gains against the American dollar during yesterday's session as better-than-estimated U.S. retail sales data sparked speculation the Federal Reserve could start trimming its massive monetary stimulus as early as September. Data released from the Commerce Department showed that retail sales rose 0.2% in July. Investors have been closely watching for clues about how and when the Fed will begin to wind down its quantitative easing program and as a result the market is paying extra attention to positive U.S. economic indicators. Although recent data releases provided further evidence that the U.S. economy is continuing to heal, we are still far from the Fed’s targets. That means even if the Federal Open Market Committee members decide to make a move in September, their first step will probably be a small one. Although I think the bulls will have more strength and volume in the short term, I expect the fact that monetary stimulus by the Federal Reserve will eventually come to an end to maintain constant pressure on gold prices. On the 4-hour time frame the XAU/USD pair is trading above the Ichimoku cloud and we still have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross. This suggests the top of cloud which currently sits at 1307 might limit the downside today. Below that, there is another strong support at 1300. A sustained break below this level could make me think that we are going to revisit 1289. To the upside, there will be an interim resistance between 1326 and 1330. If the bulls push prices above this area, the next challenges will be waiting the bulls at 1340, 1347 and 1354.50.

Gold Price Analysis - August 14, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Read more articles by Alp Kocak- Labels

- Gold