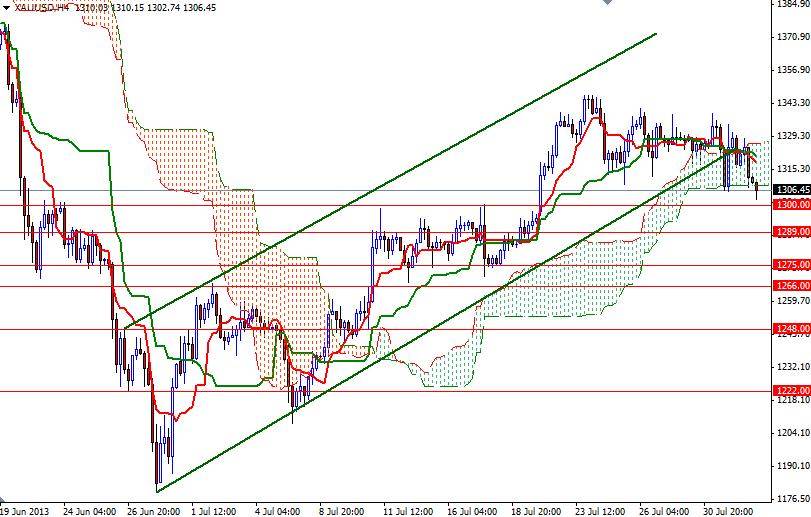

The XAU/USD pair fell for a fifth consecutive day as upbeat data on the U.S. economy boosted the Greenback’s safe-haven appeal. Investors' confidence in gold was eroded after figures released from the Institute for Supply Management showed that its index of manufacturing activity climbed to 55.4% from 50.9% a month earlier and the Labor Department reported that applications for jobless benefits fell 19K to 326K. Gold closed the day at 1310 and this is the lowest settlement in the past 8 trading sessions. The pair had been range bound for 6 days and now we are approaching the 1300 support level. As I mentioned in yesterday's analysis, closing below this level is critical because that means the weekly settlement will occur below the Ichimoku cloud (4-hour time frame) for the first time since July 9. As market sentiment is ultimately driven by expectations of tapering (no one knows when it will begin though) I think today’s main driver will be the official employment data. If data beat expectations, the market participants may flock to the relative safety of the U.S. dollar. Breaking below the 1300 level would make me think that the bears will be dominating the pair once again. In that case, they will be targeting 1275 and 1266 in the short term. If the bulls successfully defend 1300 and prices reverse, expect to see resistance at 1320.60, 1339 and 1347. Since the 1339- 1347 resistance zone has been blocking the bulls' way for some time, only a close above this level could ease selling pressure.

Gold Price Analysis - August 2, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold