Gold lost some ground against the American dollar yesterday as investors took a cautious stance and liquidated some of their positions prior to the release of the Federal Open Market Committee meeting minutes. The Federal Reserve will release records from its July 30-31 policy meeting on Wednesday. The XAU/USD pair has been resilient to the bears' attacks over the last few weeks and as a result we saw prices rising to the highest levels since June 18. Usually gold tends to gain during times of uncertainty, as the metal is widely regarded as a store of wealth but fears the Fed may start slowing the pace of its bond-buying program at its next meeting could limit the recent gains. The Federal Reserve is widely expected to cut its monthly asset purchases of $85 billion by $10 billion. Although the Fed's tapering plan seems to be supportive for the Greenback, I want to see the markets' reaction because this could also cause market players to flee from equities and prompt funds to get back into gold.

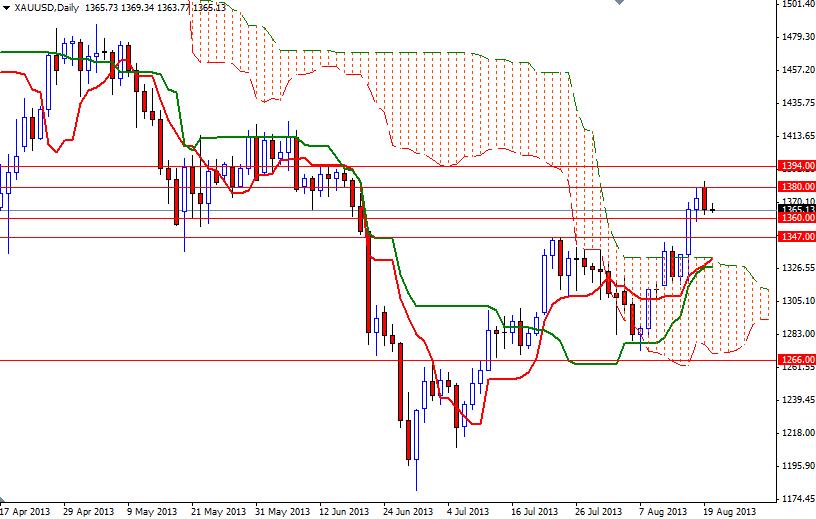

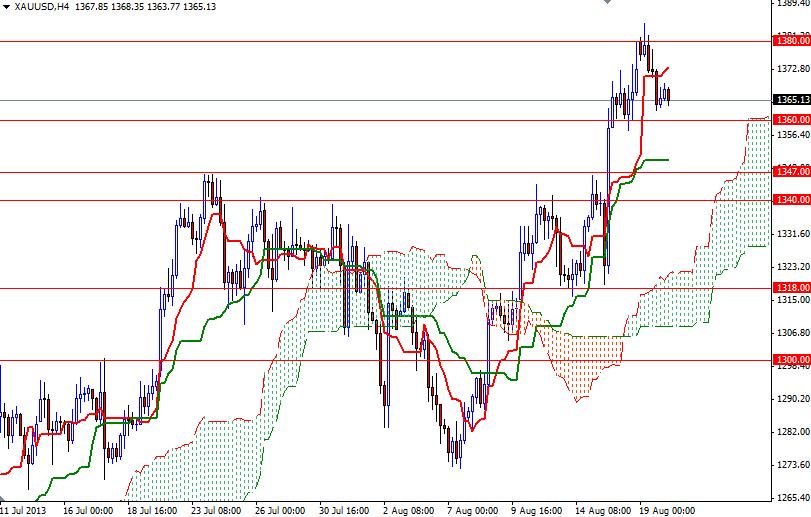

Looking at the long term charts from a purely technical point of view, (and based on the fact that the XAU/USD pair trading below the Ichimoku cloud on the weekly time frame but managed to hold above the cloud on the daily chart) I expect gold prices to remain in a massive consolidation zone between 1484 and 1150. In the meantime, I will be watching the 1360 and 1380 levels. If the bears increase the downward pressure and pull prices below 1360, the pair may revisit 1347 - 1340 area. Below that, there will be strong support at 1329.53. However, a daily close above the 1380 level would make me think that the bulls are strong enough to tackle the 1394 barrier. Beyond that point, there will be strong resistance at the 1425 level which also converges with the Fibo 38.2.