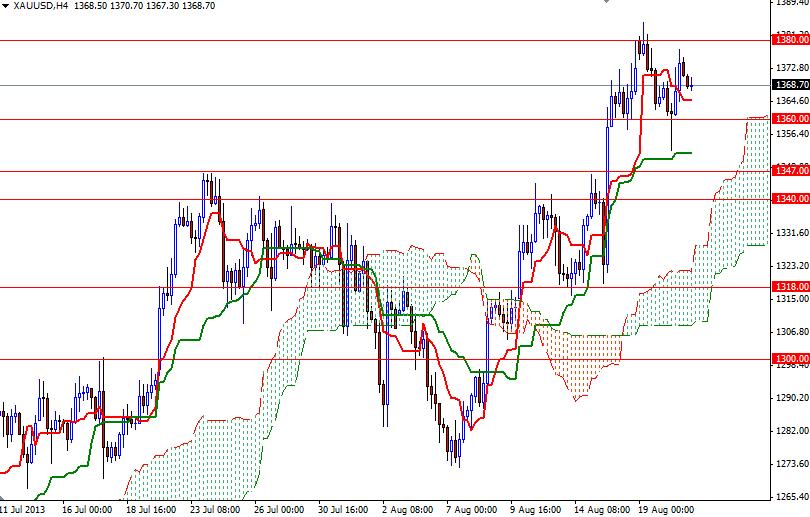

Gold prices ended yesterday's session higher after bouncing off of the 1352.37 level which converges with the Kijun-sen line (twenty six-day moving average, green line) on the 4-hour time frame. Lately, there has been a constant upward pressure on the shiny metal as speculative investors continued to cut their bearish bets and violent clashes in Egypt triggered some safe-haven interest. The primary driver of gold prices today will be the headlines from the United States. Fed’s policy meeting minutes, which will be released later today, may shed more light on the taper timing. These records also provide some useful insight into what committee members were thinking at that time. For a long time the gold market has been speculating that the Federal Reserve will reconsider its quantitative easing program and scale back the pace of the $85 billion/month asset purchases some time this year and these speculations caused prices to touch the 1180 level on June 28. If the meeting minutes reinforce expectations that the Federal Reserve will stop its quantitative easing program in the near future, that would be negative for gold.

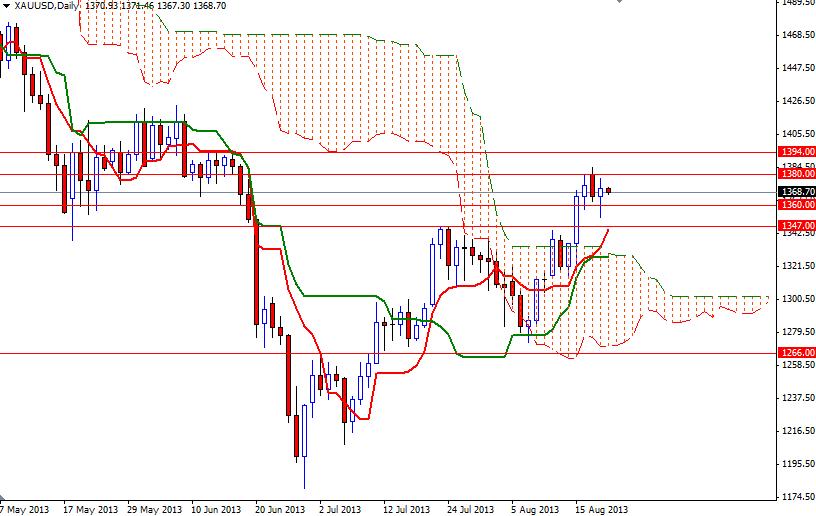

In the near-term, I think we will remain trapped between 1394 and 1347. The bulls have to break and hold above the 1394 level in order to gain enough strength to challenge the bears at 1420 - 1425 area but before that 1380 will be the first hurdle. If the bears manage to protect the 1380 barrier and the pair starts to fall, support may be found at 1360/58, 1347 and 1340.