The XAU/USD pair closed lower than opening as the American dollar gained some strength across the board after the existing home sales data released from the United States came out better than expected and minutes from the Federal Open Market Committee’s July 30-31 meeting failed to reduce the risk of a September taper.

Data released by the National Association of Realtors showed that sales increased 6.5% to a 5.39 million annual rate in July. According to the FOMC minutes, “if economic conditions improved broadly as expected, the Committee would moderate the pace of its securities purchases later this year. And if economic conditions continued to develop broadly as anticipated, the Committee would reduce the pace of purchases in measured steps and conclude the purchase program around the middle of 2014”.

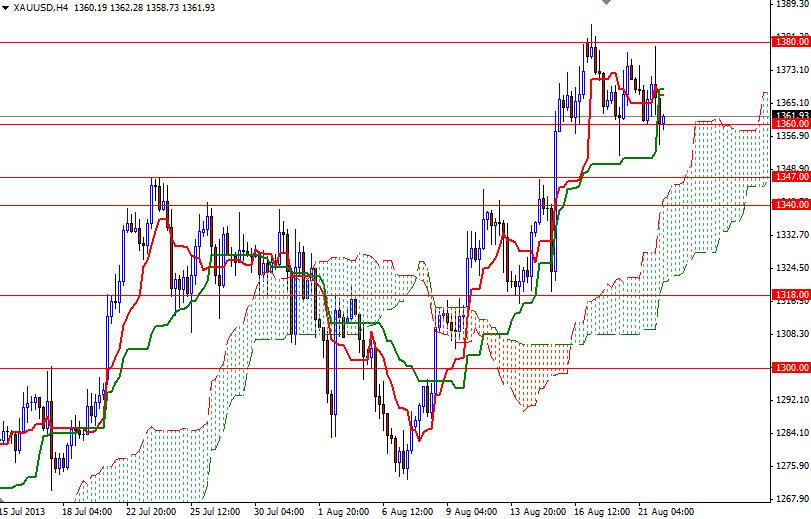

Until the markets digest the news, investors may flock to the relative safety of the American dollar in the short-term. Because of that I will be watching the 1360 and 1380 levels. Since the XAU/USD pair is trading above the Ichimoku cloud on both the daily and 4-hour charts, the retracement might be limited. If the bears take over and prices make a sustained break below 1360, I think we will test 1347, 1340 and 1328. In order to confirm a bullish continuation, a close above the 1380 is essential. If that is case, I think the bulls' first target will be 1394. Breaking above this resistance could extend this move towards 1420 - 1425 (Fibonacci 38.2 based on the bearish run from 1795.75 to 1180.21)