By: DailyForex.com

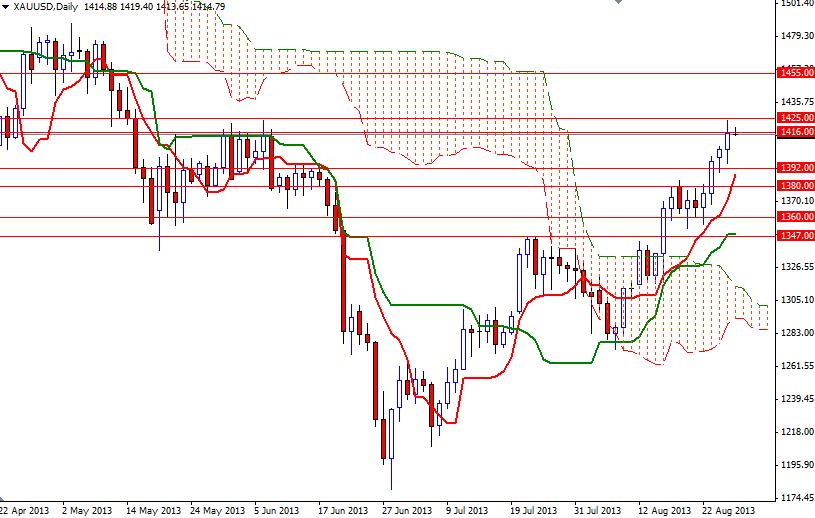

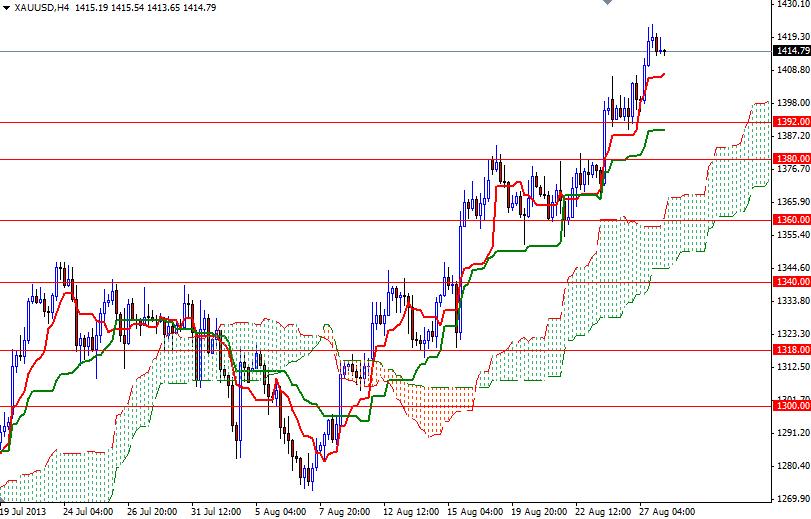

After three consecutive days of gains, the XAU/USD pair (Gold vs. the American dollar) hit the highest level since May 16. Yesterday the pair traded as high as 1423.65 but retreated back below the 1416 resistance level during the Asian session today.

Recently the markets' focus shifted to U.S. debt ceiling and geopolitical risks in the Middle East. Just a couple of days ago Treasury Secretary Jack Lew warned that the United States will reach its debt ceiling by mid-October. Probably this won’t be any different than the previous drama. The Republicans will play the debt ceiling card to force President Obama to accept deeper spending cuts.

Gold also drew strength from U.S. Defense Secretary Chuck Hagel's comments on a strike against Syria for using chemical weapons. He said American military forces located in the region were “ready to go”. In the short-term, I think fears over a military action against Syria and worries over the U.S. debt ceiling will continue to be supportive for gold.

In addition, sharp drops in the major stock markets and the USD/JPY pair might lure more investors back to the gold market. However, as I mentioned in my previous analysis, the 1416 - 1425 zone -which converges with the Fibonacci 38.2 retracement level based on the bearish run from 1795.75 to 1180.21- will be a key for the continuation of the recent bullish run and once the bulls pull the pair above this level, I think we will reach 1455 eventually.

Beyond that, there is heavy resistance at 1480. If the bears successfully defend the 1425 level and prices reverse, expect to see support at 1407, 1392 and 1380. Breaking below 1380 would suggest that we are heading back to 1360.