The NZD/CHF pair is one that I talk about often, but what I do love about this pair is that it shows the risk tolerance of traders in general. Obviously, the New Zealand dollar is a much more "riskier" currency than the Swiss franc. That being the case, when this pair rises it typically shows that the markets are in a healthy mood, and that risk is on overall. This could be translated to other markets as well as currency markets. An example might be that although there is no direct connection between these currencies in the oil markets, quite often oil will do well when this pair does also.

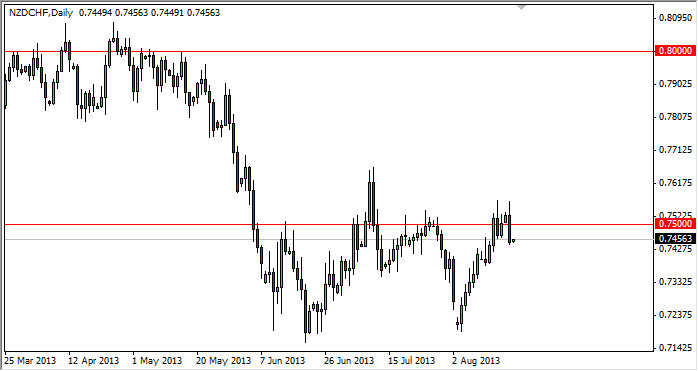

Looking at this chart, you can see that we had a very negative day on Monday, at the 0.75 handle. That being the case, it makes sense that we may start to fall from here. After all, we've been in a downtrend and there seems to be a bit of consolidation between 0.7150, and the aforementioned 0.75 handle.

Crosscurrents

There are a lot of things going on in the currency markets right now, as well as many of the other financial markets. Because of this, you have to pay attention to the various crosscurrents that are out there. Without a doubt, the Federal Reserve and what they are doing as far as quantitative easing is concerned is what is on the forefront of most trader’s minds. However, how does this affect this pair?

What I believe will happen is if the US dollar start gaining in strength it will be a bit of a "safety on" type of trade. That should put a beating on commodities in general, which of course has a negative effect on the New Zealand dollar itself. In that particular circumstance, I feel this pair will continue to fall, and probably crumble quite frankly. On a break of the lows from the Monday session, I am more than comfortable to short this pair simply because it has been so negative for most of the summer. As far as buying is concerned, I would be a bit hesitant to do that at this moment.